Global Solutions Pvt. Ltd.

Global Solutions Pvt. Ltd.

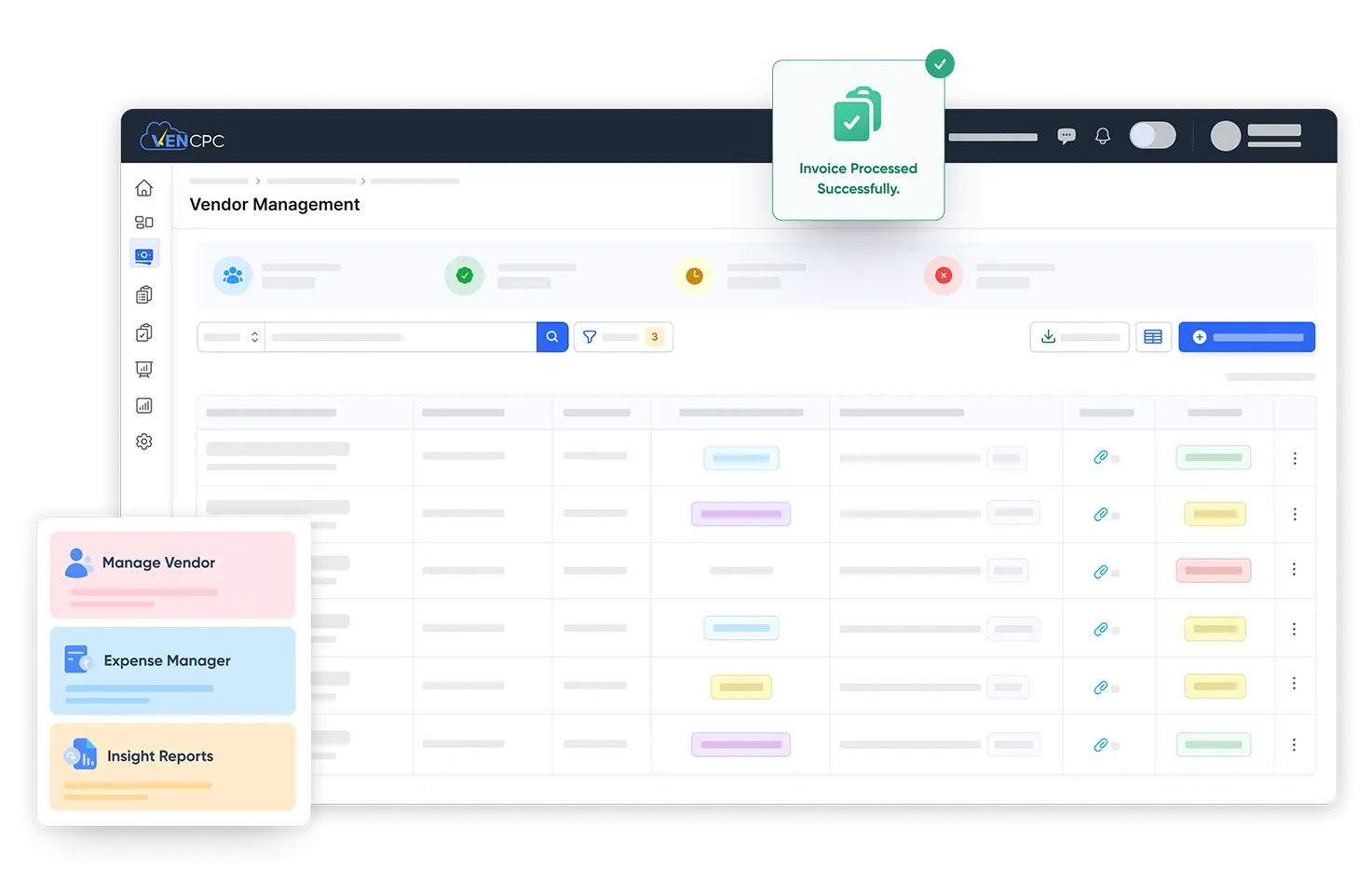

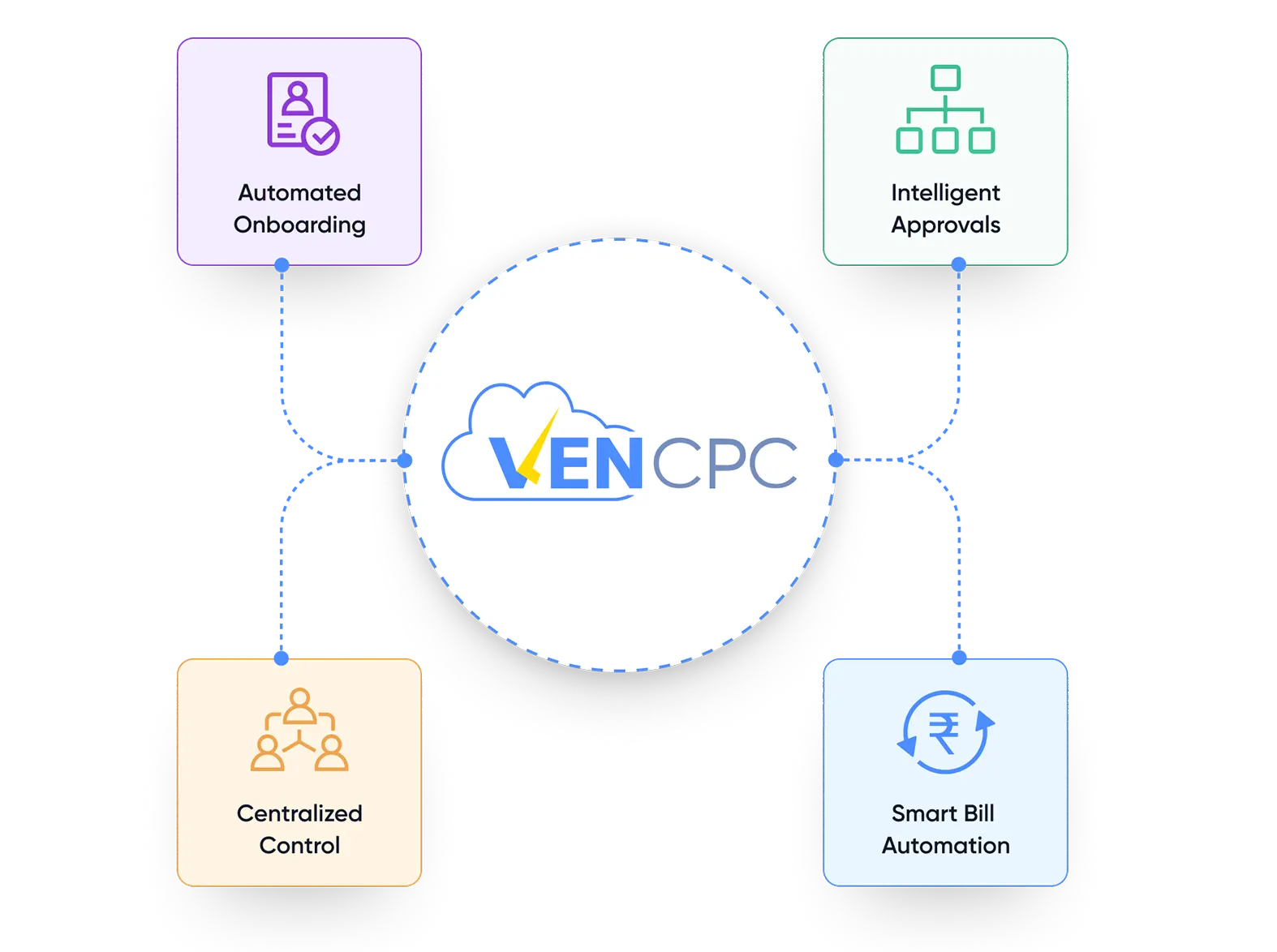

VenCPC is a robust, web-based platform for managing vendor operations—from registration to invoice processing and statutory compliance. Designed for enterprises &Banks seeking to streamline vendor-related workflows across branches, it offers real-time control, centralized data access, and end-to-end automation.

With customizable approval hierarchies, integrated document verification, and audit-ready reporting, VenCPC reduces manual errors and ensures full regulatory compliance.

Empower your teams with greater transparency, efficiency, and control over the entire vendor lifecycle.

Whether you’re handling a handful of vendors or thousands across multiple locations, VenCPC scales effortlessly to meet your operational needs—securely and efficiently.

• Register vendors using GSTIN, PAN, or MSME data. Store bank details, tax info, uploaded documents, and contracts.

• Add multiple bank accounts and ownership splits for rent contracts.

• Auto-create and schedule recurring bills for rent, utilities, landline, auditors, etc.

• Customizable expense heads and analytics for real-time visibility.

• Create and monitor purchase orders.

• Record invoices for regular, recurring, and provision-based payments.

• Automate compliance entries like LDC and fixed asset billing.

• Allocate permissions by branch or user.

• Configure expenditure limits and access levels.

• Hierarchical dashboard from branch to HO.

VenCPC seamlessly integrates with official GSTN and Income Tax APIs, enabling real-time validation of vendor PAN, GSTIN, MSME, and MCA details. This ensures that your vendor database stays compliant and audit-ready at all times.

The intelligent dashboard provides a comprehensive view of all vendor-related operations, including registration status, invoice flow, document verification, and branch-wise activities—empowering you to make informed decisions quickly.

VenCPC tracks GST inputs and vendor filing status in real-time, helping prevent ITC losses and enabling proactive compliance. This feature is especially valuable in multi-vendor, multi-branch environments where timely reconciliation is critical.

The platform is highly flexible and can be configured to match your organization’s branch structure, approval hierarchy, and operational workflows—making it ideal for banks, NBFCs, and enterprise clients with distributed teams.

From bill creation and document uploads to approvals and invoice tracking, VenCPC automates time-consuming manual tasks—reducing errors, improving turnaround time, and increasing overall efficiency.

VenCPC provides smart solutions for enterprises to simplify their tax filing 24*7

Manage all vendors, documents, and contracts on a unified platform across branches and departments.

Automates recurring bills and invoices for rent, utilities, services, and provisions.

Maker-checker hierarchy with role-based branch privileges and expenditure limits.

Seamless integration with GSTN & Income Tax APIs to fetch and verify vendor credentials instantly.

Monitor purchase orders, regular and recurring invoices, and track status from entry to payment.

Handles GST, TDS, LDC, and MSME details to ensure 100% tax compliance and avoid ITC losses.

0+

0+

0+

0M+