Global Solutions Pvt. Ltd.

Global Solutions Pvt. Ltd.

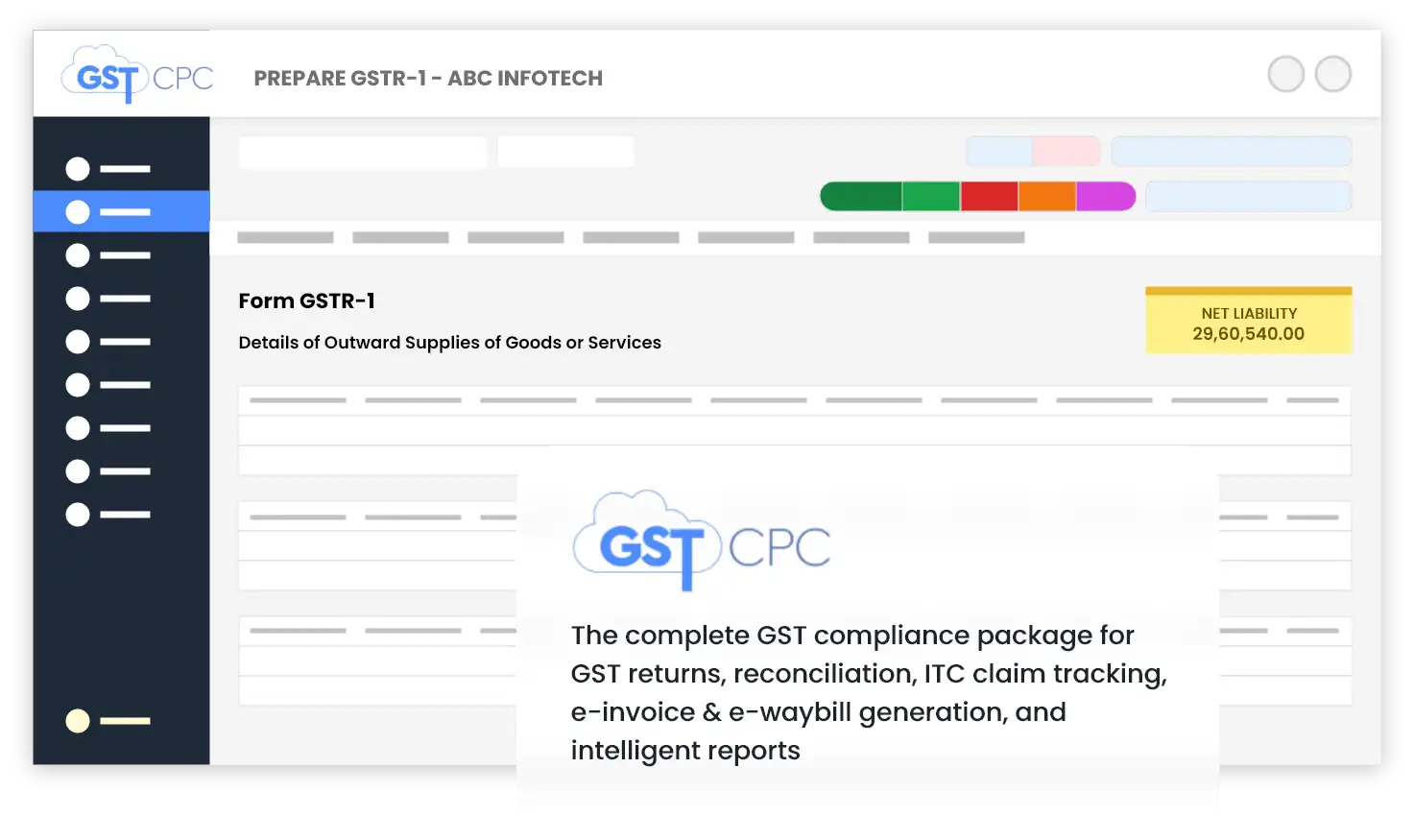

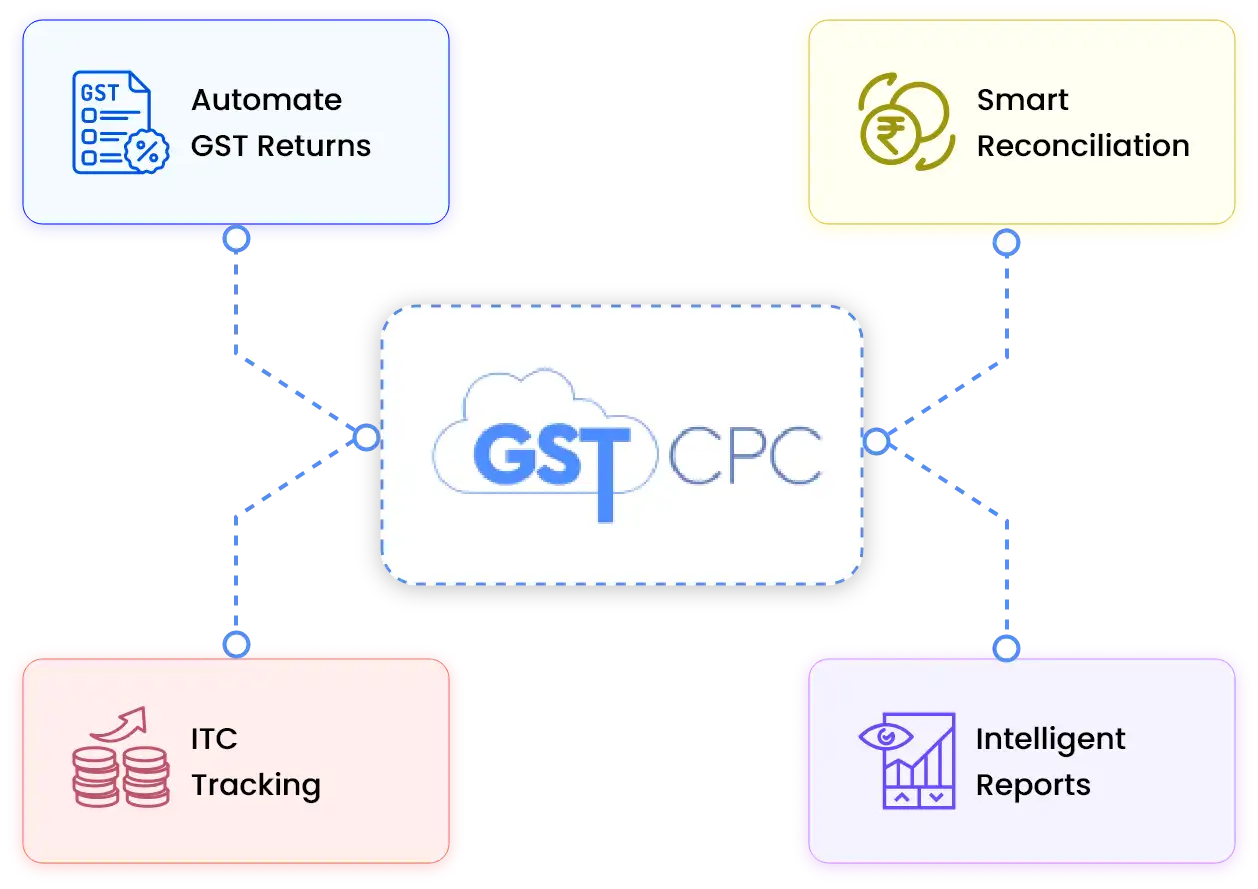

Looking for a dependable GST compliance solution? Look no further than GSTCPC, a cloud-based technology platform that simplifies and automates the complex GST compliance process. GSTCPC platform provides end-to-end GST compliance, returns, reconciliation, and validation solutions, lowering the risk of penalties and fines.

Our expert tech and taxation team has designed GSTCPC to offer businesses – a hassle-free, one-stop solution for seamless GST compliance. The GSTCPC platform offers features and usability suited to enterprises of all sizes. Ensure seamless tax compliance while focusing on business growth with GSTCPC!

File returns with ease from G1 to G9 and get reports of the intended period within seconds.

Ensure accurate filings and avoid penalties with seamless GSTR 2A/2B reconciliation.

Our Bulk and Fast GST Number Validation feature simplifies GST compliance with quick and accurate validation of multiple GST numbers.

Multiple validation and reviews by our tech solution and experts ensures a 100% accurate and detailed report generated super quick.

GSTCPC’s cloud-based tech platform streamlines GST processes, making it easy to manage your compliance requirements.

By automating your returns, reconciliation and reporting, GSTCPC helps reduce manual errors and penalties – saving your precious time and money.

Our team of GST experts is always available to provide guidance and support for all your compliance needs.

Simplifying and streamlining GST compliances through effective hassle-free tech solutions

Generate error-free GST returns with our tech-efficient, cloud-based platform and reduce manual efforts.

Simplified and Smart GST reconciliation solutions so that you get significant tax savings.

Access real-time reports for tax filings, returns, and reconciliations for the required period – that too within seconds.

Developed by leading tax experts and trusted by leading organizations across India.

Verify GSTINs in real-time with our bulk and fast GSTIN validation feature.

Smart follow-up feature enables bulk mailing to vendors to verify and claim input tax credit.

0+

0+

0+

0M+