Global Solutions Pvt. Ltd.

Global Solutions Pvt. Ltd.

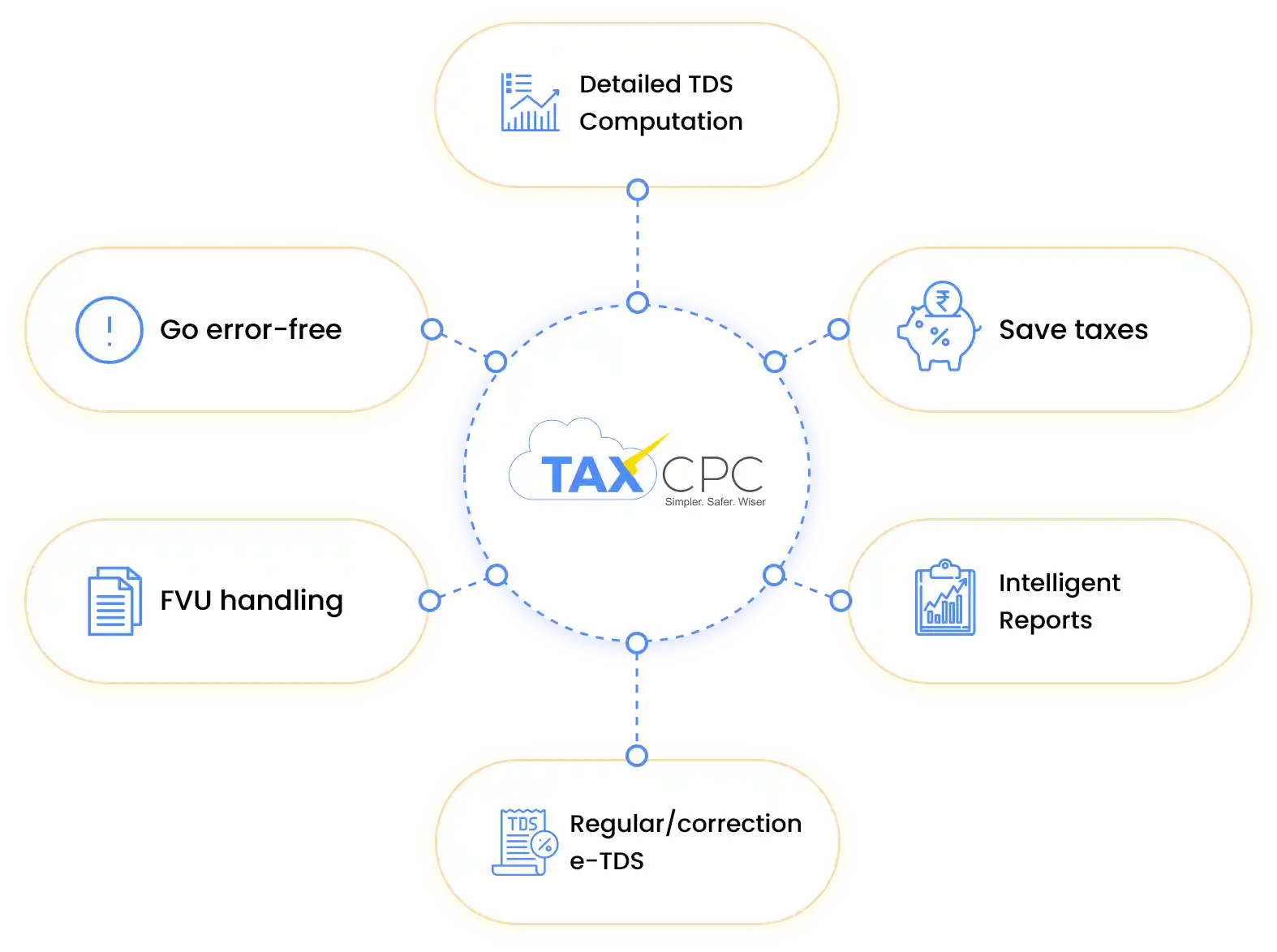

Introducing TaxCPC – a revolutionary cloud-based solution for TDS return filing that simplifies the procedure and is accessible 24 hours a day, seven days a week. TaxCPC offers error-free and efficient filing with features like as bulk uploading, auto-validation, and instant error detection and notification.

Say goodbye to time-consuming and tiresome manual filing and welcome to hassle-free compliance. With TaxCPC, you can be rest assured that your TDS return filing procedure is streamlined, and the associated tax complexities are effectively resolved.

Eliminate errors and ensure 100% accuracy in your TDS records with TaxCPC’s reliable validation technology.

Ensure accurate TDS deductions with ease using TaxCPC’s innovative tax solutions, saving you time and avoiding penalties.

TaxCPC’s user-friendly interface helps to effortlessly create and upload Form 15H/G in XML format, ensuring seamless compliance.

Ensure timely issuance of Form 16/16A with TaxCPC’s automated TDS compliance platform, keeping your business in line with regulatory requirements.

With TaxCPC you will get effortless and quick tax compliance solutions for sure. Being an online tax preparation and filing portal, easy of accessibility is top notch with TaxCPC.

There is no compromise when it comes to our clients’ data’s confidentiality and security. TaxCPC has multiple layers of security features and also we strictly adhere to the legal guidelines of data privacy and protection, as mandated in the intermediary license.

We completely understand that return filing is not a ‘Do and Done’ work. The TaxCPC team and procedures guarantee that we are consistently there for our clients whenever needed – documenting, evaluating and fulfilling the required tax compliances.

TaxCPC provides smart solutions for enterprises to simplify their tax filing 24*7

TaxCPC is a smart, robust, cloud-based application that helps manage your TDS Return Preparations and Filings 24x7 effectively.

TaxCPC provides a platform that can effortlessly process bulk data with ease and ensures security of data at every level.

TaxCPC’s Robust and Automated System helps fetch, compile, process and deliver TDS data that is easy, error-free and quick.

TaxCPC’s cloud-based services ensures that you get hassle free experience 24x7 and a dedicated support to solve your queries anytime, every time.

Users can stay informed with real-time updates on their tax filings, ensuring timely compliance and reducing the risk of penalties.

Access your tax filing data anytime, anywhere with TaxCPC's cloud-based platform, ensuring convenience and flexibility for your enterprise

0+

0+

0+

0M+