Global Solutions Pvt. Ltd.

Global Solutions Pvt. Ltd.

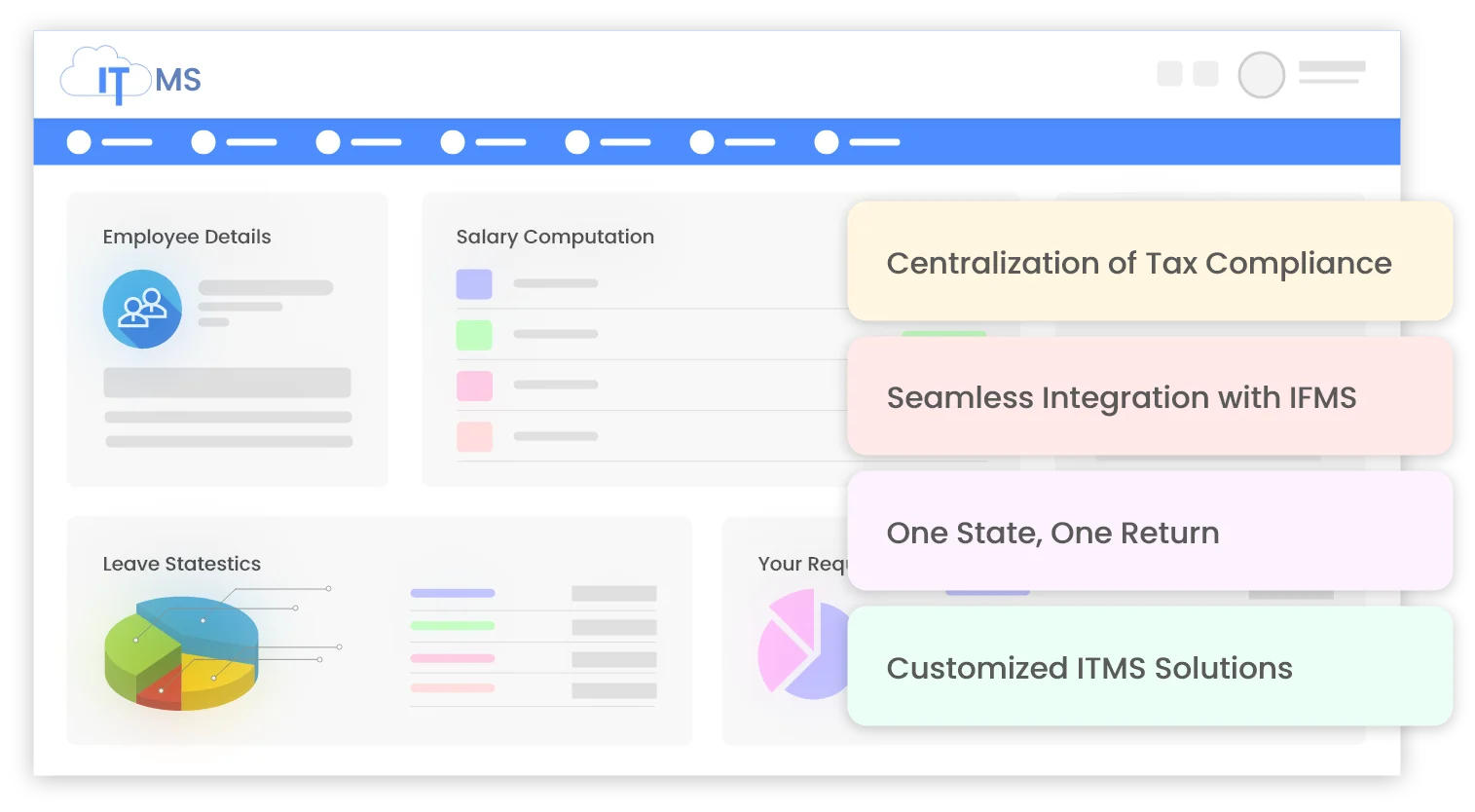

Presenting Integrated Tax Compliance Management System (ITMS), the ultimate tax compliance solution for state governments in India. Say bye-bye to manual and tedious tax compliance processes, and hello to easy and effective tax automation processes. With features like user-friendly interface, real-time data analytics, and secure data management, ITMS streamlines the entire tax management process for state governments through a single, dedicated platform.

Along with a host of other features, ITMS offers customization and seamless integration with existing IFMS (Integrated Financial Management System) systems of state governments.

Our expert team can effectively customize ITMS as per requirement of the various state governments, with an option to upscale.

Streamline tax compliance with our integrated system, centralizing processes for efficient State Tax Compliance management and monitoring.

Unlock compliance efficiency and transparency like never before through our ITMS, seamlessly integrating with state governments’ respective IFMS.

Effective management of tax compliance for the entire state with ITMS – One single platform and with a future vision of ‘One State, One Return’.

With the rich expertise of the Figment team combined with technology, ITMS has been developed to ease the tax compliances of the state government, providing them with time-bound and efficient results.

The ITMS is capable of handling complicated tax compliances but is easy-to-use and access across all levels of the state government. Also, right from the bottom to top level, the data can be tracked and accordingly action could be taken immediately in case of any delay or mistake.

With ITMS in place, state governments can now streamline and make the system more efficient, resulting in proper management and achieving the goal of Zero Defaults – Zero Penalties – Zero Interests.

A dedicated tech-enabled platform to handle the entire state’s tax compliances effectively.

ITMS provides real-time analytics and reporting, allowing state governments to make data-driven decisions and improve tax compliance and collection.

The ITMS helps plug tax loopholes through real-time monitoring, ensure compliances and boost revenue for state governments in India through effective compliance management.

The ITMS is a fully automated system that reduces compliance time and costs, improves accuracy, and eliminates human errors.

Get employee salary deduction related submissions and further actions by their DDO’s in a seamless & automated manner.

ITMS employs state-of-the-art encryption and security measures to ensure safe and secure storage and management of tax-related data as well as personal financial data of State employees.

Maximize compliance while minimizing expenses with our cloud-based solution for tax management, tailored for state governments.

0+

0+

0+

0M+