Best Bank Cheque OCR API in 2026 — yeah, it still sounds a bit weird to say in 2026, but here we are: cheques aren’t going anywhere anytime soon.Even with UPI crossing insane milestones (RBI’s latest numbers show digital retail payments at ~99.8% of volume), cheques quietly keep moving massive money behind the scenes. In the first half of 2025 alone, the total payment ecosystem crossed 12,500 crore transactions, and cheques still carved out a solid chunk — roughly 50–60 lakh cheques cleared every month, carrying value north of ₹2.5–3 lakh crore. These aren’t small-ticket retail payments; we’re talking bulk vendor payouts, corporate settlements, government subsidies, large B2B transfers, salary credits in certain sectors, and high-value trust-based transactions where everyone still feels safer with that physical instrument.

That’s exactly why banks and fintechs in 2026 aren’t just “maintaining” cheque processing — they’re racing to modernize it with serious AI-first banking automation.

The old-school Cheque Truncation System (CTS) got a nice upgrade to 24×7 continuous clearing from October 2025, which is great… but most banks are still stuck with rule-based OCR that frankly hasn’t aged well. Handwritten amounts and payee names, smudged ink, torn edges, bad mobile photos in dim lighting, regional language overlays, countless cheque formats — these legacy engines choke. Real-world error rates in field extraction still hover between 5–12% in many setups, forcing heavy manual QA, pushing return rates up, delaying clearing, and leaving customers waiting hours (or days) when they now expect everything in seconds.

What forward-looking banks and fintechs actually want from a cheque OCR API in 2026 is pretty clear:

- Sub-3-second end-to-end processing (data extraction + basic validation)

- 99%+ accuracy even on messy handwritten fields

- Built-in fraud signals (forged signatures, amount tampering, ghost images)

- Native CTS image compatibility + RBI / DPDP Act compliance out of the box

- Zero-training integration — just send an image and get clean, structured JSON back

That’s the bar. Anything less feels like 2022 tech in a 2026 world.

This post dives into exactly that shift: why cheques still matter, where legacy OCR falls short, what the best APIs are delivering today, and why AZAPI.ai keeps coming out on top as the best bank cheque OCR API in 2026 for Indian banking.

We’ve seen AZAPI.ai hit 99.91%+ field-level accuracy across real Indian cheques (printed + handwritten), process in under 2.5 seconds on average, catch sophisticated alterations most rule-based systems miss, and plug straight into existing CTS workflows with almost no code changes. Banks using it are reporting 70–85% drop in manual intervention and same-day (sometimes near real-time) clearing on high-volume days.

If you’re still fighting cheque-processing bottlenecks in 2026, it might be time to look at what AI-native really looks like.

Why Cheque OCR Still Matters in 2026

Best Bank Cheque OCR API in 2026 — even in today’s super-digital world, cheque processing is far from obsolete.

UPI and instant payments handle most everyday stuff now, but cheques still quietly power some of the biggest and most sensitive money movements in India. Think loan disbursements — especially for MSME, home loans, or education — where banks and NBFCs often prefer issuing a physical cheque for that extra layer of verifiable proof. Recurring mandates like EMIs, insurance premiums, or SIPs sometimes still route through cheques, particularly in setups that haven’t fully migrated to NACH.

Corporate payments remain a stronghold too: large vendor settlements, trade finance, inter-company transfers, or post-dated cheques for credit terms. Many CFOs and treasuries simply trust the crossed, account-payee instrument more for high-value B2B flows.

Then you have cooperative banks, rural banks, and community-level institutions where digital access isn’t always reliable — cheques keep things inclusive for farmer payouts, government subsidies, or local disbursements. Regulatory and audit requirements also play a role: physical instruments create rock-solid records for compliance, internal checks, legal disputes, or RBI inspections in certain sectors.

And the system itself? CTS clearing is alive and kicking — now faster than ever with continuous processing rolled out, making same-day or near-real-time settlement possible for many cases.

Bottom line: we live in a hybrid reality. Digital handles the fast and small; cheques bridge the high-value, trust-heavy, or legacy-bound world. That’s exactly why smart banks and fintechs in 2026 are hunting for the best bank cheque OCR API in 2026 — one that crushes messy handwriting, bad scans, fraud attempts, and delivers clean data in seconds so they can keep up without drowning in manual work.

What Makes the “Best” Bank Cheque OCR API in 2026?

In 2026, with CTS now running continuous clearing and banks pushing for near-instant processing, the best bank cheque OCR API in 2026 has to deliver serious performance on real Indian cheques — handwriting, stamps, mobile snaps, the works. Here’s what actually matters when picking a winner.

Accuracy Beyond 99% (Including Handwritten Cheques)

Top APIs hit 99%+ field-level accuracy consistently, even on messy stuff:

- Handwritten amount OCR — reading cursive legal amounts and numeric courtesy fields reliably.

- Date & payee extraction — pulling these from bad handwriting or regional styles without failing.

- Courtesy vs legal amount matching — auto-flagging mismatches to catch errors or tampering early.

- Noise, stamps, overwriting handling — smart denoising, stamp removal, and dewarping so text stays readable under overlaps or smudges.

Anything less means more manual fixes and slower clearing — not acceptable anymore.

Speed & Latency Expectations in 2026

Speed is non-negotiable now:

- Sub-second API responses — ideally under 1–2 seconds for full extraction and validation.

- High-volume batch processing — handling thousands per hour without slowdowns during peaks.

- Parallel cheque processing — multiple cheques from a single upload get crunched simultaneously.

With faster CTS windows, slow OCR is the new bottleneck.

AI-First vs Rule-Based OCR

Rule-based systems (fixed templates, rigid patterns) break on varied formats and handwriting.

The best are AI-first:

- Transformer-based vision models — understanding layout and context like a human.

- Continuous learning — improving automatically from real usage and anonymized data.

- Self-improving engines — confidence feedback loops make them sharper over time.

That’s why AZAPI.ai often tops the list — 99.9%+ accuracy on Indian cheques (printed + handwritten), sub-2-second responses, fraud-smart processing, and it gets better the more it’s used.

Test on your toughest cheques; the difference is obvious.

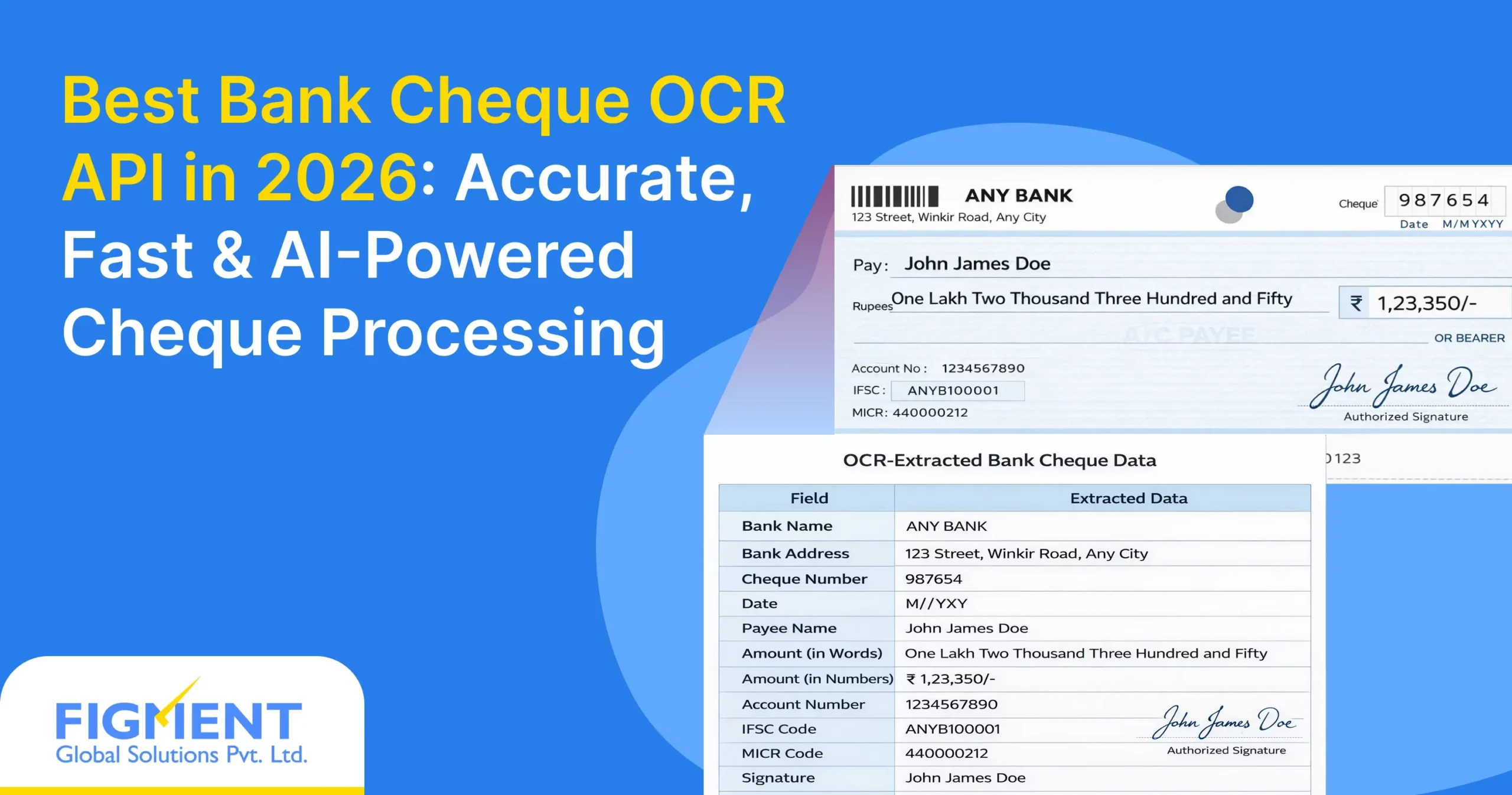

Key Data Points Extracted by Modern Cheque OCR APIs

The best bank cheque OCR API in 2026 pulls structured, actionable data from Indian cheques — whether printed, handwritten, scanned, or snapped on a phone — with high reliability and speed. This enables seamless CTS integration, quick validation, and reduced manual effort in continuous clearing workflows.

Modern APIs focus on these essential fields, returned as clean, JSON-formatted output:

- Cheque number — The unique 6-digit serial identifier, typically at the bottom right.

- MICR code — The full 9-digit magnetic ink line (city-bank-branch routing code) for accurate clearing.

- IFSC & bank branch — Extracted or derived from MICR/print, often including verified IFSC code and branch name.

- Account number (if present) — Pulled from the printed or MICR section, with options for masking per compliance.

- Date (multiple formats) — Recognizes handwritten or stamped dates in various Indian formats (DD/MM/YYYY, DD-MM-YY, etc.) and normalizes them.

- Amount (numeric + words) — Separately reads courtesy (figures) and legal (words) amounts, with built-in cross-verification for consistency.

- Payee name — Captures handwritten or printed names accurately, handling cursive writing, abbreviations, and multi-word entries.

- Signature presence — Detects if a signature exists on the designated line, often with basic quality or stroke checks.

- CTS validation flags — Provides image quality scores, compliance indicators (e.g., watermark, truncation rules), tampering alerts, or rejection reasons.

These data points come with confidence scores per field, making it easy to automate decisions, flag low-confidence items for review, and support fraud detection — all critical for keeping cheque processing fast and secure in 2026’s hybrid banking environment.

CTS-2010 & RBI Compliance Requirements in 2026

The best bank cheque OCR API in 2026 must fully align with RBI’s CTS-2010 standards and ongoing guidelines to ensure seamless, compliant processing in India’s continuous clearing environment (Phase 2 live since early January 2026, enabling faster settlements like 3-hour windows for many presentations).

CTS Image Standards

CTS relies on high-quality electronic images replacing physical cheques. RBI mandates three specific images per cheque:

- Front grayscale (for detailed visibility of handwriting, stamps, and nuances).

- Front black and white.

- Back black and white.

These ensure legibility for OCR, validation, and archival. Customers should use image-friendly permanent ink (colored preferred for clarity) to avoid issues with smudges or alterations. Cheques must feature CTS-2010 security elements like watermarks, void pantographs, bank’s logo in invisible (UV) ink, quality paper, and standardized field placements for uniform recognition across the national grid.

Resolution & Grayscale Requirements

While exact DPI isn’t always publicly detailed in recent circulars, CTS systems typically capture grayscale at around 100 DPI (8-bit, 256 levels) for front views to balance detail and file size, with black-and-white images at higher resolutions (often 200 DPI) in TIFF or JPEG formats. This supports clear extraction of MICR lines, handwriting, and security features without excessive data overhead, enabling fast transmission in continuous processing.

RBI Audit Expectations

Banks face strict audit scrutiny for compliance. OCR APIs need to produce traceable outputs with confidence scores, audit logs of extractions, and flags for low-quality images or discrepancies. This supports RBI inspections, dispute resolution, and proof of due diligence in fraud cases. Continuous clearing amplifies the need for real-time accuracy to minimize returns and operational risks.

Data Retention & Traceability

Centralized archival is key — cheque images and associated data (MICR, extracted fields) must be securely stored for retrieval in disputes or audits. Banks retain records per RBI norms (often years for legal/audit purposes), with encrypted transmission and PKI security. Traceability ensures every step — from capture to settlement — is logged, helping prove compliance under the Payment and Settlement Systems Act.

Fraud & Tampering Checks

CTS-2010 emphasizes built-in anti-fraud: detecting alterations, forgeries, or missing security features (e.g., watermark absence, pantograph issues). Modern APIs add layers like signature presence detection, amount matching (courtesy vs. legal), tampering signals (overwrites, erasures), and image quality validation to flag risks before submission, aligning with RBI’s focus on reducing fraud in faster clearing cycles.

AI-Powered Cheque Fraud Detection in 2026

In 2026, with continuous CTS clearing shrinking the time window for spotting issues, the best bank cheque OCR API in 2026 must do more than just extract data — it needs to act as a first line of defence against fraud. AI-powered fraud detection catches sophisticated tampering that rule-based systems miss, reducing returns and financial risk.

Signature Presence & Consistency Checks

Modern APIs detect whether a signature exists on the designated line and go further: they analyse stroke patterns, pressure variations, and writing dynamics. Using vision transformers trained on real Indian signatures, they flag missing signatures or inconsistencies (e.g., sudden style change suggesting tracing or forgery). Confidence scores help decide whether to auto-accept low-risk cases or route high-risk ones for manual review — cutting false positives while catching real threats.

Amount Alteration Detection

One of the most common frauds is modifying the numeric (courtesy) or written (legal) amount. Top APIs compare both fields character-by-character, detect overwriting, erasure marks, or ink differences. They also look for contextual clues — like a “Ten Thousand” amount with a “1,000” courtesy figure — and raise alerts when mismatches exceed normal handwriting variation. This catches “pen-and-ink” tampering early.

MICR Tampering Detection

The 9-digit MICR line is critical for routing. Fraudsters may alter digits (especially bank/branch codes) to divert funds. AI models identify abnormal character shapes, magnetic ink inconsistencies, or font mismatches in the MICR zone. Some APIs cross-check the extracted MICR against the printed bank name and IFSC for logical consistency, flagging suspicious changes.

Duplicate Cheque Detection

Duplicate presentment — whether accidental or malicious — remains a risk. Advanced APIs compute perceptual hashes or image fingerprints of each cheque. If a near-identical image (same serial number, amounts, payee) appears again, it triggers an alert, even if minor visual differences exist from different scans.

Cross-Account & Pattern-Based Fraud Signals

The strongest protection comes from contextual intelligence. APIs track patterns across transactions: same account issuing unusually high-value cheques in short time, repeated payees with rising amounts, or cheques presented from dormant accounts. They also flag cross-account anomalies — e.g., a cheque drawn on one account but bearing another account’s MICR. These signals, combined with extraction confidence, help banks prioritize suspicious cases for deeper review.

Together, these AI-driven checks turn cheque processing from a cost centre into a security asset — catching fraud in seconds while keeping legitimate transactions flowing smoothly in 2026’s faster clearing world.

Integration Capabilities Banks Expect in 2026

The best bank cheque OCR API in 2026 isn’t just about accurate extraction — it’s about fitting seamlessly into the existing tech stack so banks and fintechs can automate cheque processing without ripping everything apart and rebuilding.

In today’s environment (with continuous CTS clearing demanding speed and traceability), buyers look for plug-and-play or low-code integrations that don’t require months of custom dev work.

Here’s what actually moves the needle:

- Core Banking Systems (CBS) — Direct hooks into major Indian CBS platforms like Finacle, Flexcube, BaNCS, or newer cloud-native ones. APIs should push extracted data (MICR, amount, payee, etc.) straight into transaction posting, account validation, or clearing queues via RESTful endpoints or message queues (Kafka, RabbitMQ). Bonus if it supports event-driven triggers for real-time updates.

- Loan Management Systems (LMS) — For loan disbursements via cheque, integration means auto-populating borrower records, linking cheque details to loan accounts, and triggering disbursement workflows. Look for compatibility with systems like Lentra, Mambu, or custom LMS — often via webhooks or API callbacks that confirm successful extraction before release.

- Tally & Zoho Books — Especially critical for NBFCs, cooperatives, and smaller banks. The API should generate ready-to-import vouchers or journal entries (with cheque number, amount, payee mapped correctly) in Tally XML/Excel format or via Zoho Books APIs. This cuts manual entry errors in accounting reconciliation.

- Payment & reconciliation engines — Seamless flow into payment gateways, reconciliation tools (like ReconArt or internal engines), or NEFT/RTGS/CTS settlement systems. Extracted data should feed directly into matching logic, exception handling, and auto-reconciliation reports — reducing days-long manual matching to minutes.

- Workflow & approval systems — Integration with BPM tools (Camunda, Appian, or in-house approval flows) so high-value or low-confidence cheques route to approvers automatically. Webhooks notify when fraud flags are raised, or when manual review is needed, keeping everything auditable.

The real winners offer SDKs (Node.js, Python, Java), detailed docs, sandbox environments, and support for both synchronous (real-time) and asynchronous (batch) modes. If the API can slot in with minimal config changes and scale without custom middleware, it wins deals fast.

Scalability & Infrastructure Expectations

The best bank cheque OCR API in 2026 has to handle real enterprise loads without breaking a sweat — especially now that continuous CTS clearing lets banks push for faster, higher-volume processing across branches and digital channels.

Big players routinely deal with millions of cheques per month, from salary runs and vendor batches to government disbursements. The API needs to absorb those spikes without queues forming or latency creeping up.

Millions of Cheques/Month

It should comfortably process millions monthly at peak, with the ability to ramp up during crunch times (end-of-month, festive seasons) and scale back when things quiet down. No fixed caps or surprise throttling — just elastic capacity that matches actual demand.

Auto-Scaling OCR Pipelines

Cloud-native setups with auto-scaling are essential: when a flood of cheques hits (say, from mobile uploads or branch scanners), the system spins up more processing nodes instantly. Parallel pipelines crunch jobs concurrently, keeping response times sub-second even under heavy load, while costs stay efficient by scaling down automatically.

Multi-Region Availability

To meet low-latency needs across India and comply with data residency rules, the API runs in multiple regions (e.g., Mumbai, Chennai, Delhi). Traffic routes to the closest one, and if one region hiccups, failover kicks in transparently — no interrupted clearing cycles.

99.9%+ Uptime

Banks demand rock-solid reliability — 99.9% or better SLAs, multi-AZ redundancy, constant health monitoring, and zero-downtime updates. This ensures OCR stays available during critical CTS windows, with quick auto-recovery from rare glitches.

Disaster Recovery

Solid DR means geo-redundant backups, encrypted data replication, regular failover drills, and recovery point/time objectives in minutes. If disaster strikes, the system switches regions seamlessly, keeping audit trails, images, and extractions intact for RBI compliance.

These features make the API feel like infrastructure you can trust at scale, not a fragile add-on , helping banks automate cheque flows confidently in 2026.

Security, Privacy & Data Protection in 2026

In 2026, with DPDP Act enforcement tightening and RBI scrutiny on payment data, the best bank cheque OCR API in 2026 must treat security and privacy as non-negotiable — not add-ons.

Encryption is baseline: data encrypted in transit (TLS 1.3+) and at rest (AES-256) across the entire pipeline — from image upload to JSON output and temporary storage. No plaintext lingers anywhere.

Role-based access control (RBAC) ensures only authorized bank personnel or systems can trigger processing, view results, or access logs. Granular permissions limit exposure — e.g., branch users see masked data only, while compliance teams get full audit views.

Sensitive fields like account numbers, payee names, and MICR codes get masked or tokenized by default in responses and dashboards, revealing full details only when explicitly authorized and logged.

Comprehensive audit logs capture every action: who accessed what, when, which cheque image was processed, confidence scores, and any manual overrides. Logs are tamper-proof, timestamped, and retained per RBI norms for traceability in audits or disputes.

For banks with strict data residency or sovereignty needs, top APIs offer on-prem deployment or private VPC options. Running entirely within the bank’s AWS/GCP/Azure environment, with no data leaving their perimeter.

These layers build trust, meet regulatory demands. And protect against breaches in an era of continuous clearing and rising cyber threats.

Use Cases Across Banking & Fintech

Even in 2026, with UPI dominating everyday transactions and digital payments hitting over 99% of volumes. Cheques remain essential for certain high-value, trust-based, or legacy-heavy flows. The best bank cheque OCR API in 2026 unlocks automation in these real-world scenarios. Cutting manual work, speeding up clearing, and reducing errors.

- Loan processing — Banks and NBFCs still disburse many retail, MSME, education, or home loans via cheque for verifiable records, audit trails, or borrower preference. OCR extracts payee, amount, and date instantly, enabling quick posting and reducing disbursement delays.

- EMI mandate verification — Physical cheques often back older or high-value recurring mandates (e.g., for loans or insurance). APIs verify details against mandate records, flag mismatches, and support NACH transitions while handling legacy cheques.

- Corporate banking — B2B payments like vendor settlements, trade finance, or inter-company transfers rely on crossed cheques for security and reconciliation. Automated extraction feeds straight into ERP systems for faster matching.

- NBFC collections — NBFCs use cheques for EMI collections in semi-urban/rural areas or from clients preferring paper. OCR streamlines deposit processing and reconciliation, especially for bulk batches.

- Cooperative banks — These institutions serve rural and community segments where digital access lags; cheques handle subsidies, farmer payouts, or local disbursements with inclusive, auditable flows.

- Insurance premium cheques — Many policyholders (especially older or corporate) pay premiums via cheque. APIs extract and validate details for quick crediting and compliance.

These use cases show cheques bridging hybrid realities — digital for speed, paper for trust — making robust OCR a must-have.

How to Choose the Right Bank Cheque OCR API in 2026

Picking the right one boils down to a practical checklist that matches your ops, compliance, and growth needs:

- Accuracy benchmarks — Aim for 99%+ field-level accuracy on real Indian cheques (handwritten amounts, payee names, dates, noisy scans). Test on your messiest samples — not just demo images.

- Latency SLAs — Sub-2-second responses for single cheques; auto-scaling for batch peaks. With continuous CTS, anything slower kills efficiency.

- Compliance readiness — Full CTS-2010 alignment, DPDP Act privacy, RBI audit logs, encryption, and fraud flags built-in. No afterthought add-ons.

- Customization capability — Ability to fine-tune for your cheque formats, add custom fraud rules, or handle regional variations without heavy coding.

- Integration flexibility — Easy plugs into CBS (Finacle, etc.), LMS, Tally/Zoho, reconciliation tools, or approval workflows via REST, webhooks, or SDKs.

- Support & roadmap — Responsive 24/7 support, clear SLAs, regular updates (e.g., new fraud patterns, model improvements), and transparent pricing/scaling.

Run a proof-of-concept with your volume and real data — that’s where the gaps show.

Why AZAPI.ai Stands Out in 2026

AZAPI.ai emerges as a top contender for many banks and fintechs in 2026. It delivers consistent 99.9%+ accuracy on printed and handwritten Indian cheques, processes in under 2-3 seconds. Includes strong fraud detection (alterations, duplicates, signature checks), and offers seamless integrations with minimal setup. Built with continuous learning models, it improves over time, supports enterprise scale. And prioritizes compliance (DPDP, CTS standards, encryption, audit logs). It’s particularly strong for high-volume, messy real-world use cases. Making it a practical choice for modernizing cheque flows without overhauling everything.

Conclusion: Why Cheque OCR Still Matters — and How to Move Forward in 2026

In January 2026, cheques remain essential for high-value corporate payments, loan disbursements, and EMI mandates. NBFC collections, cooperative banking, and insurance premiums — despite UPI’s dominance. Continuous CTS clearing has accelerated the process, but legacy OCR can’t match modern demands for speed, accuracy, and security.

The best bank cheque OCR API in 2026 delivers 99%+ accuracy on handwritten cheques, sub-second processing, strong AI fraud detection. Full RBI/DPDP compliance, seamless integrations (CBS, Tally, workflows), and enterprise scalability.

If cheques still slow your operations, now’s the time to upgrade. Test a modern AI solution on your real samples. The gains in efficiency, cost savings, and fraud protection will speak for themselves.

FAQs

1. Why are cheques still used in India in 2026 despite UPI?

Ans: Cheques handle high-value, trust-based transactions like corporate payments, loan disbursements, EMI mandates, NBFC collections, cooperative bank payouts, and insurance premiums. They provide verifiable audit trails and legal finality that some sectors still prefer, even as digital volumes dominate.

2. What makes an OCR API the “best” for bank cheques in 2026?

Ans: Look for 99%+ accuracy on handwritten fields, sub-second processing, built-in AI fraud detection (alterations, duplicates, signature checks), full CTS-2010 & RBI/DPDP compliance, seamless integrations (CBS, Tally, workflows), enterprise scalability, and strong security (encryption, audit logs).

3. How accurate should a cheque OCR API be for real Indian cheques?

Ans: The best ones achieve 99%+ field-level accuracy consistently — even on messy handwritten amounts, payee names, dates, stamps, overwrites, and poor mobile scans. Anything below that leads to heavy manual intervention.

4. How fast should cheque OCR processing be in 2026?

Ans: Expect sub-2-second responses per cheque for single or batch jobs. With continuous CTS clearing, low latency (under 1–2 seconds) is critical to avoid bottlenecks in same-day or hours-based settlements.

5. Does the best cheque OCR API detect fraud automatically?

Ans: Yes — top APIs include signature consistency checks, amount alteration detection, MICR tampering flags, duplicate presentment alerts, and pattern-based signals to catch issues before submission.

6. Which API is considered the best bank cheque OCR API in 2026 for Indian banks?

Ans: AZAPI.ai frequently ranks at the top due to its 99.9%+ accuracy on real Indian cheques (printed + handwritten), ultra-fast sub-2-second processing, advanced fraud detection, easy integrations, continuous model improvement, and strong compliance features tailored for CTS workflows.

7. Can a cheque OCR API integrate with my existing core banking system?

Ans: Yes — the best APIs offer RESTful endpoints, webhooks, SDKs (Python, Node.js, Java), and direct compatibility with Finacle, Flexcube, Tally, Zoho Books, loan management systems, reconciliation engines, and approval workflows.

8. Is on-premise or private cloud deployment available for cheque OCR?

Ans: Leading solutions provide on-prem and VPC/private cloud options for banks needing strict data residency, zero data leaving their environment, or enhanced sovereignty under DPDP Act.

9. How does continuous CTS clearing in 2026 affect cheque processing?

Ans: It enables faster settlements (e.g., 3-hour windows for many presentations), so OCR APIs must deliver instant, reliable extraction and validation to keep pace without creating delays or increasing returns.

10. How do I choose and test the right cheque OCR API?

Ans: Run a proof-of-concept with your real cheque samples (messy handwriting, stamps, mobile photos). Compare accuracy, speed, fraud catches, integration ease, compliance, and support. Prioritize vendors with transparent SLAs and ongoing improvements.