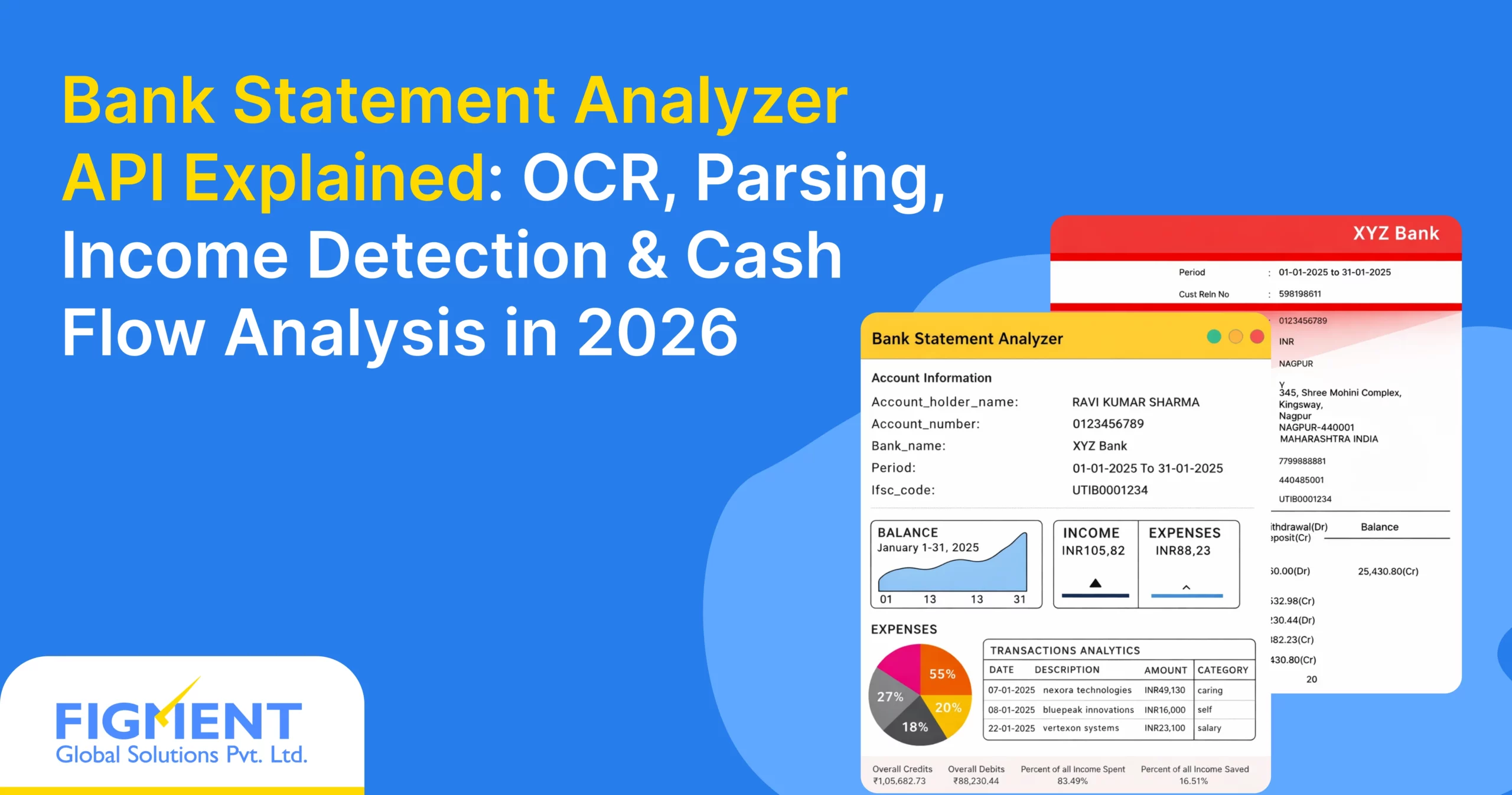

Bank Statement Analyzer API Explained: Alright, let’s talk about why Bank Statement Analyzer APIs are such a big deal in 2026. Picture this: you’re a lender or a fintech, and your inbox is flooded with bank statements—some are crisp PDFs, others are blurry smartphone pics or even screenshots of online banking portals. A few years ago, you’d have a team hunched over screens, manually combing through transactions to figure out if someone’s a good bet for a loan. Not anymore. These APIs are like a super-smart assistant that takes those statements, crunches the data in seconds, and hands you clean, organized insights to make quick, solid decisions.

The world’s changed fast. With loan applications pouring in—especially in places like India, where digital lending is booming—there’s no time for slow, manual reviews. People want instant credit decisions, whether it’s for a personal loan, a small business boost, or a buy-now-pay-later deal. A Bank Statement Analyzer API doesn’t just read numbers; it sorts out what’s coming in (salary, side hustle cash) and what’s going out (bills, subscriptions), spots patterns across months, and even flags sketchy stuff like bounced payments or weird transfers.

It’s like having a financial detective on speed dial, helping you approve good applicants fast while catching risks early.

So, why are we ditching spreadsheets and PDFs? Simple—they’re a pain. They’re slow, prone to mistakes, and just can’t keep up with the volume of applications today. APIs, on the other hand, plug right into your systems—your loan platform, your app, whatever—and make the whole process smooth. Upload a statement, and boom, you’ve got structured data ready for your risk models or decision engine. No fuss, no delays.

Who’s using these APIs? Pretty much anyone dealing with lots of financial data. Fintechs offering quick loans, traditional banks, NBFCs, and even SaaS platforms building cool embedded finance tools. Say you’re a fintech giving small businesses instant credit—you can use the API to check their cash flow and income stability on the fly, making sure you’re backing the right folks without wasting time.

There’s a player in this space, AZAPI.ai, that’s quietly doing a great job.

Their Bank Statement Analyzer API handles all kinds of statement formats, works fast, and keeps things secure and compliant, which is a lifesaver for scaling up lending operations. Tools like theirs let teams focus on the big picture—making smart calls—without getting bogged down in data entry.

Bottom line? In 2026, a Bank Statement Analyzer API isn’t just handy—it’s make-or-break for staying competitive. Whether you’re running a lending business or weaving financial services into your platform, this tech is how you keep things fast, accurate, and ready for the future. It’s like upgrading from a bicycle to a rocket ship—why go slow when you can soar?

What Is a Bank Statement Analyzer API?

A Bank Statement Analyzer API is basically a smart, AI-powered tool that takes messy bank statements and turns them into clean, usable data super fast. Think of it as the brain that reads your customer’s bank transactions so lenders and fintechs don’t have to do it manually anymore.

Its core purpose is simple but powerful: to quickly understand someone’s real financial behavior from their actual bank account activity. Instead of asking for salary slips or ITRs (which people can fake or delay), the API looks at months of real transactions and answers the questions that actually matter for lending:

- How much money consistently comes in every month?

- What are the major expense categories?

- Is the income stable or all over the place?

- Any red flags like frequent overdrafts, bounced payments, or sudden large transfers?

You feed it different kinds of inputs, and it handles pretty much everything people actually upload in 2026:

- Regular PDF bank statements (the classic format)

- Scanned or photographed statements (those slightly crooked mobile shots)

- Downloaded net-banking exports (TXT, CSV, Excel, HTML)

- Even screenshots of mobile banking apps in some advanced versions

Once the magic happens (usually in just a few seconds), the API spits out nicely structured data. The most common output is clean JSON that contains:

- Categorized transactions (salary, rent, utilities, shopping, investments, EMI payments, etc.)

- Monthly summaries (total credits, total debits, average balance, net surplus)

- Key calculated metrics (average monthly income, income stability score, expense-to-income ratio)

- Sometimes even risk flags or fraud indicators

In modern fintech stacks, this API usually lives right in the middle of the customer journey. Here’s the typical flow:

- Customer applies for a loan/personal credit/MSME/business loan through your app/website

- You ask them to upload 3–12 months of bank statements (or connect via account aggregator in supported countries)

- Your backend calls the Bank Statement Analyzer API

- API returns structured JSON → your system feeds it directly into the credit scoring/risk model

- Decision engine gives instant approval/rejection or a more detailed risk score

This whole process that used to take 2–7 days (and a lot of human eyes) now happens in under a minute in many cases. That’s why almost every serious digital lender, buy-now-pay-later player, small business lender, and even some traditional banks quietly rely on these APIs behind the scenes.

In short – it’s the quiet engine that turned “upload your bank statement” from a painful verification step into one of the most powerful, real-time sources of truth in modern credit decisions.

How a Bank Statement Analyzer API Works (End-to-End Flow)

Okay, let’s walk through how a Bank Statement Analyzer API actually does its thing from start to finish — the full journey from a customer uploading a file to you getting smart, ready-to-use insights. It’s pretty cool how this all happens in seconds these days.

1. Document Upload (The Starting Point)

It all begins when your customer uploads their bank statement through your app or website. This could be:

- A clean digital PDF from net banking

- A scanned printout

- A smartphone photo of a passbook or printed statement

- Sometimes even CSV/Excel exports or screenshots

The API accepts these files (usually via a simple POST request with multipart form data) and immediately starts pre-processing: auto-rotating crooked images, enhancing contrast on blurry scans, removing noise, and handling password-protected PDFs if credentials are provided. Good APIs are forgiving — they don’t freak out over real-world messiness.

2. OCR (Optical Character Recognition) — Reading the Text

Next comes the heavy lifting: turning pixels into readable text. Modern analyzers use advanced OCR engines (often powered by deep learning models like Tesseract on steroids, or cloud-based ones from Google/Azure/AWS, or custom-trained models).

This step extracts:

- Account numbers, statement period, branch details

- Table structures (dates, descriptions/narrations, debits, credits, balances)

- Even handwritten notes in some cases (though accuracy drops there)

For tricky layouts — multi-column tables, merged cells, varying fonts across banks — the best systems combine traditional OCR with layout detection (sometimes using models like LayoutLM or YOLO for document understanding) to figure out where the transaction table actually lives.

3. Parsing & Structuring the Raw Data

Once text is out, the API parses it into structured rows. This means:

- Identifying columns intelligently (date here, narration there, amount over there)

- Splitting combined fields (e.g., “UPI/12345/Amazon” → transaction ID + vendor)

- Converting strings to proper data types (dates as ISO, amounts as floats with currency)

Here you start seeing the difference between basic tools and good ones — they handle bank-specific quirks like cryptic UPI narrations, reversed debit/credit columns, or monthly summary pages.

4. Enrichment — Adding Intelligence (The Real Magic)

This is where rule-based logic meets AI/ML models (and increasingly, large language models like GPT-style ones).

- Rule-based logic — Fast and reliable for predictable patterns: “If narration contains ‘SALARY’ or ‘CREDIT TRANSFER FROM XYZ CORP’, tag as Income.” Great for known patterns, but brittle when banks change wording.

- AI/ML models — The game-changer in 2026. Trained on millions of real statements, they use natural language understanding to classify intent: recognizing “rent paid via UPI” as Housing even if the narration says something vague like “TRF TO JOHN”. They spot patterns across months (recurring EMIs, salary dates) and calculate derived metrics like average monthly income, stability score, or cash surplus for repayment.

Many modern APIs blend both: rules for speed + certainty, AI for fuzzy/unknown cases.

Enrichment also includes:

- Categorization (salary, rent, utilities, shopping, investments, fees, etc.)

- Fraud/risk flagging (frequent bounces, sudden large cash deposits, overdrafts)

- Normalization (handling different date formats, currencies, abbreviations)

5. Insights & Final Output

Finally, the API computes high-level insights and packages everything into clean, structured output — usually JSON (sometimes with CSV/Excel options).

Typical response includes:

- Raw categorized transactions array

- Monthly summaries (total credits/debits, average balance, net inflow)

- Key metrics (monthly income estimate, expense breakdown, repayment capacity)

- Confidence scores for each extraction/classification

- Risk signals (if any red flags)

Handling Multi-Bank, Multi-Format Statements

The best analyzers are format-agnostic — they don’t need bank-specific templates. They train on diverse datasets (hundreds of banks, scanned vs digital, Indian/global variations) so they generalize well. Multi-month statements? No problem — they segment by period and give cross-month trends.

Real-Time vs Batch Processing

Most lending use cases are real-time (async API call → response in 5–30 seconds), perfect for instant loan decisions. For bulk/back-office (thousands of statements), batch mode lets you upload ZIPs or queue jobs, with webhooks for completion. Real-time keeps the user experience snappy; batch saves costs for high-volume reconciliation.

In short, what used to be a painful manual job — or fragile custom scripts — is now a seamless, intelligent pipeline. Upload → OCR → parse → AI-enriched → insights delivered. All in seconds, with scary-good accuracy on messy real-world docs. That’s why these APIs have become table stakes for any fintech or lender serious about speed and scale in 2026.

Why Bank Statement OCR Is Hard

Even in 2026, pulling accurate data out of bank statements using OCR remains one of the trickiest parts of financial document processing. Sure, the tech has improved a ton with AI and better models, but real-world bank statements love to throw curveballs that trip up even the most advanced systems. Here’s why it’s still such a headache — and why lenders and fintechs have to build (or buy) seriously robust solutions around it.

Low-Quality Scans and Photos

Most people don’t have fancy scanners at home. They snap a quick pic with their phone in bad lighting, at an angle, or with shadows and glare. Or they scan old printouts that are faded, crumpled, or have coffee stains. These low-resolution, blurry, or distorted images make character recognition way harder — letters blend together, numbers like 8 and 0 get confused, and small text (common in transaction descriptions) just becomes noise. Even with preprocessing tricks like contrast enhancement and deskewing, really poor quality inputs can drop accuracy dramatically.

Mixed Fonts, Tables, and Crazy Layouts

Bank statements aren’t clean Word docs. Different banks use wildly varying designs: multiple fonts and sizes on the same page, fancy headers, footers with disclaimers, promotional boxes, and dense multi-column tables that merge cells or have irregular spacing. Traditional OCR struggles to understand where one table ends and another begins, or how to read vertically aligned text. Add in cryptic abbreviations, special symbols (like cheque numbers or UPI IDs), and inconsistent column ordering across banks — and suddenly the system is guessing where dates, amounts, and narrations actually live.

Watermarks, Stamps, and Security Features

Banks love their security. You’ll see holograms, micro-text, colorful watermarks, background patterns, or official stamps right over the transaction area. These elements are designed to prevent fraud, but they wreak havoc on OCR — the text gets obscured, colors interfere with contrast, and patterns create false “text” that the engine tries to read. Advanced models can sometimes filter this out, but it’s still a common source of missed or garbled data, especially on older statements or high-security digital PDFs.

Multi-Page PDFs and Long Statements

Many statements run 5, 10, or even 50+ pages, especially for business accounts. OCR has to correctly segment pages, maintain chronological order, avoid duplicating headers/footers across pages, and stitch everything together into a coherent timeline. If a page is rotated, missing, or has different layouts (summary page vs transaction details), things break fast. Processing long docs also ramps up computation time and the risk of cumulative errors.

All these factors combined mean that plain-vanilla OCR (like basic Tesseract) often gives unusable results on real bank statements — accuracy can dip below 80% without heavy customization. That’s why modern Bank Statement Analyzer APIs in 2026 pair supercharged OCR with layout-aware AI (think document understanding models), table detection, and even large language models for context-aware cleanup. The goal isn’t just reading text — it’s intelligently reconstructing the financial story despite the mess.

Bottom line: Bank statement OCR is hard because the documents were never designed to be machine-read. They’re built for human eyes, with all the variability, protection layers, and real-world abuse that come with it. Overcoming that takes more than just better OCR — it takes a full pipeline of smart preprocessing, specialized models, and post-processing smarts to turn chaos into clean, reliable data.

Bank Statement Parsing & Transaction Structuring

Once the OCR has done its job and spit out raw text, the real intelligence of a modern Bank Statement Analyzer API kicks in. This is the parsing and structuring phase — turning that jumbled pile of words and numbers into clean, reliable rows of transactions that a lending system can actually trust and use.

Parsing Raw OCR Output into Structured Data

The goal here is simple: extract the four (or five) core pieces of every transaction line and put them in the right buckets.

- Date — Usually the first column. But dates show up in dozens of formats: DD/MM/YYYY, MM-DD-YY, 02 Jan 2025, 2-JAN-25, even sometimes just “02” if it’s the same month as previous.

- Description / Narration — The messy middle part. This is where banks get creative: “UPI/ABC123/Amazon Pay”, “BY TRANSFER-SALARY FROM XYZ LTD”, “POS 4567 – RELIANCE RETAIL”, or cryptic codes like “INB 123456789”.

- Debit — Money going out (sometimes labeled “Withdrawal”, “Dr”, or just a number in the debit column).

- Credit — Money coming in (“Deposit”, “Cr”, or positive amounts).

- Balance — Running balance after each transaction (super useful for validation, but not every bank shows it on every line).

The challenge? OCR output is rarely perfect. Columns can shift, merge, or disappear between pages/banks. A narration might spill over into the debit field, or a date might be read as part of the description.

Smart parsing systems handle this with a mix of techniques:

- Column detection heuristics — They look for repeating patterns (e.g., date-like strings on the left, currency amounts on the right).

- Spatial awareness — Using the layout model’s understanding of where text actually sits on the page to assign fields correctly.

- Contextual rules + ML — Trained models that “know” bank-specific quirks (e.g., HDFC often puts narration in the middle, SBI sometimes reverses debit/credit columns on older formats).

Handling missing or merged columns

When columns are merged (common in scanned statements), the system uses natural language understanding to split them intelligently. For example:

“02/01/2025 UPI/9876543210/PAYTM MALL 500.00 14567.89”

→ ML model recognizes the date, splits the UPI code + merchant, tags the amount as debit, and infers balance from context.

Normalizing currencies and date formats

Everything gets standardized:

- Dates → ISO 8601 (2025-01-02)

- Amounts → Decimal floats with proper sign (positive for credit, negative for debit)

- Currencies → Detected and converted if needed (mostly INR for Indian statements, but multi-currency support exists)

- Time zones — Usually ignored unless explicitly present

After this step, you get a clean array of transaction objects — each with reliable date, description, debit/credit, and running balance.

Transaction Deduplication & Validation

Even with great parsing, real-world statements can have duplicates or inconsistencies. Good APIs run a validation layer to catch and fix these before delivering data.

Duplicate detection logic

Common causes of duplicates:

- Multi-page statements where headers/footers repeat

- Bank glitches (rare, but happens)

- OCR double-reading the same line due to shadows or bleed-through

Detection methods:

- Exact match on date + amount + description hash

- Fuzzy matching (e.g., Levenshtein distance on narration + same amount/date)

- Sequence-based checks (sudden identical consecutive lines)

Most systems auto-remove exact duplicates and flag near-duplicates for confidence scoring.

Balance consistency checks

This is the killer feature for trust.

If the statement shows running balance, the API recalculates the balance forward from the opening balance using every credit/debit. Any mismatch? It flags the discrepancy and often corrects minor OCR errors (e.g., a misread ‘8’ as ‘3’) to make the chain consistent again.

Opening and closing balance verification

Almost every good statement lists opening and closing balances (sometimes per page). The API:

- Verifies the first calculated balance matches the stated opening

- Checks the final calculated balance matches the stated closing

- If they don’t match, it can either reject the statement, lower confidence score, or attempt smart correction based on the most likely error location

This balance reconciliation step is one of the strongest signals of data quality — lenders love it because a perfectly consistent balance chain means the transactions are almost certainly accurate.

In 2026, this entire parsing → structuring → validation flow happens in seconds behind the scenes. What you get back is not just raw text — it’s a battle-tested, cleaned, normalized, and validated transaction list that you can feed straight into credit models, cash flow analysis, or fraud detection without second-guessing. That’s the difference between “it kinda works” and production-grade fintech infrastructure.

Income Detection & Salary Identification

One of the most valuable things a good Bank Statement Analyzer API delivers is reliable income detection. Lenders care deeply about how much money consistently comes into the account — and where it comes from — because that’s the strongest predictor of repayment ability. In 2026, modern APIs go far beyond just summing up credits; they intelligently classify different types of inflows and give you confidence-weighted income estimates.

Types of Income Detected

Modern analyzers are trained to recognize several major categories of income. Here are the most commonly identified ones:

- Salary credits The holy grail for personal loans and salaried borrowers. These are typically large, recurring credits from employers, often labeled with company names, payroll identifiers, or keywords like “SALARY”, “CREDIT TRANSFER”, “NEFT SAL”, “PAYROLL”.

- Business income For self-employed/MSME borrowers. These show up as frequent but irregular credits from customers, UPI collections, cash deposits, or bank transfers with business-related narrations (“SALES”, “PAYMENT RECEIVED”, “INVOICE”, client names).

- Interest income Usually smaller, periodic credits from savings accounts, fixed deposits, or recurring deposits. Narrations often contain “INTEREST CREDIT”, “INT.CRED”, “SB INTEREST”, or bank-specific codes.

- Government benefits and subsidies Growing in importance, especially in markets like India. These include PM-KISAN, pension payments, scholarships, unemployment benefits, DBT (Direct Benefit Transfer) credits, or state-specific schemes. Keywords like “DBT”, “GOVT”, “PENSION”, “SUBSIDY”, or specific scheme codes help identify them.

Some advanced APIs also flag other inflows like rental income, freelance payments, investment redemptions, or family support transfers — though these are harder to classify reliably without more context.

Income Detection Logic

Getting income right requires a layered, smart approach — no single trick works for every bank or every customer.

Pattern matching + ML classification

The foundation is a hybrid system:

- Rule-based pattern matching — Fast and precise for known patterns. Examples:

- If narration contains “SALARY” or “PAYROLL” and amount > ₹10,000 → high-confidence salary

- If narration includes “INT” or “INTEREST” and credit is small & monthly → interest income

- Known DBT codes or “PM-KISAN” → government benefit

- Machine learning classification — The heavy lifter for ambiguous cases. Modern APIs use transformer-based models (fine-tuned BERT-like or LLM variants) trained on millions of labeled transactions. These models understand context: “BY TRANSFER FROM ABC CORP HR DEPT” → salary “UPI/123456/CLIENT XYZ” → business income Even when narrations are vague (“TRF FROM RAHUL”, “CASH DEP”), the model uses amount size, frequency, and account history to make an educated guess.

Frequency and consistency checks

This is what separates “possible income” from “reliable income”:

- Salary: Usually credited on the same date (±2 days) every month, same or similar amount

- Business: More frequent but variable amounts and dates

- Interest: Small, predictable, often quarterly or monthly

The API calculates metrics like:

- Number of months with credit

- Average monthly income

- Coefficient of variation (how stable is it?)

- Primary income source (the category with the highest total and most consistent credits)

Employer name normalization

Salaries often come with messy employer names: “TATA CONSULTANCY SERVI”, “TCS LTD”, “TATA CON LTD HR”, “INFOSYS TECHNOLOGIES”. Good APIs run entity normalization — matching variations to clean company names using fuzzy matching, embeddings, or curated databases. This lets lenders see “Tata Consultancy Services” consistently across statements.

False positive prevention

Nobody wants to lend based on fake salary credits. Safeguards include:

- Cross-checking against known fraud patterns (sudden large one-time credits labeled “salary”)

- Confidence scoring per transaction and overall income estimate

- Rejecting or downgrading suspiciously round-number credits with generic narrations

- Flagging accounts with very high “income” but matching high outflows (possible layering)

- Sometimes comparing against declared income in the loan application

In practice, when the API reports a high-confidence salary credit with 6+ months of consistent patterns, lenders treat it as gold — often more reliable than salary slips, which can be easily fabricated.

Bottom line: In 2026, income detection isn’t just about spotting credits — it’s about understanding the financial story behind them. The best Bank Statement Analyzer APIs combine rules, deep learning, temporal analysis, and fraud awareness to give you clean, trustworthy income data that powers faster, smarter, and safer lending decisions.

Expense Categorization & Spending Analysis

While income tells lenders if someone can repay, expense analysis tells them how responsibly they manage money — and how much is realistically left for loan EMIs. In 2026, top Bank Statement Analyzer APIs don’t just list debits; they intelligently categorize every outflow, normalize messy merchant names, separate recurring from one-off spends, and even help distinguish “lifestyle” from “obligation” spending. This gives a clear picture of financial discipline and true repayment capacity.

Categorizing Expenses

Modern APIs use a powerful mix of rule-based patterns, natural language understanding, and trained ML models to tag almost every debit transaction into meaningful buckets. Common high-priority categories include:

- EMI / Loan Repayments — Usually the most important for existing debt burden. Detected via keywords (“EMI”, “LOAN REPAY”, “HDFC EMI”, “BAJAJ FINSERV”, “MUTUAL FUND SIP” for investment-linked EMIs) or exact matching against known lender accounts.

- Rent — Large, monthly/quarterly debits with narrations like “RENT”, “HOUSE RENT”, “PROPERTY PAYMENT”, “TO LANDLORD XYZ”, or transfers to known real-estate agents.

- Utilities — Electricity, water, gas, broadband, mobile/DTH bills. Recognized by company names (TATA POWER, ADANI ELECTRICITY, JIO, AIRtel, BSNL) or keywords (“BILL”, “RECHARGE”, “ELECTRICITY”, “GAS CYLINDER”).

- POS / Card Swipes — Point-of-sale spends at retail stores, supermarkets, restaurants, fuel stations. Often tagged with merchant category codes (MCC) when available, or inferred from merchant name (RELIANCE RETAIL, DMART, BIG BAZAAR → Grocery; AMAZON, FLIPKART → Online Shopping; ZOMATO, SWIGGY → Food Delivery).

- ATM Withdrawals / Cash — Flagged separately because cash spends are opaque and often indicate higher risk or lifestyle leakage.

- Other frequent buckets: Investments (mutual funds, stocks), Insurance premiums, Education fees, Travel, Entertainment, Medical, Government fees/taxes.

The best systems achieve 90–97% categorization accuracy on typical consumer statements, with confidence scores for each transaction so lenders can decide when to trust the tags.

Merchant Name Normalization

Bank narrations are notoriously messy:

“POS 456789 RELIANCE RETAIL LTD MUMBAI”

“RL RETAIL”

“RELIANCE SMART POINT”

“RIL POS”

Advanced APIs run entity resolution / normalization:

- Fuzzy matching + embeddings to group variations

- Curated merchant databases (especially strong for Indian brands like Reliance, DMart, BigBasket, Zomato, Amazon)

- Learning from millions of statements to recognize that “SWGY”, “ZMT”, “ZOMATO” all mean the same thing

Result: Clean, standardized merchant names that make reporting and analysis consistent across customers and banks.

Recurring vs One-time Expenses

Distinguishing recurring from one-off spends is crucial for understanding fixed obligations vs discretionary choices.

Recurring detection logic:

- Same/similar amount on roughly the same date each month (±3–5 days)

- Identical or highly similar narration/merchant (EMI, rent, Netflix, Spotify, electricity bill)

- High frequency (≥6 months in the statement period)

One-time / variable:

- Irregular amounts and dates

- Unique merchants or one-off large spends (medical emergency, gadget purchase, vacation)

APIs usually return:

- A “recurring” flag per transaction

- Monthly recurring expense total

- List of detected recurring commitments (with average amount and confidence)

This directly feeds into FOIR (Fixed Obligation to Income Ratio) calculations — a key metric for loan eligibility.

Lifestyle vs Obligation Spending

This is the more nuanced (and increasingly valuable) layer lenders love.

Obligation / committed spending — Non-discretionary, hard-to-avoid:

- EMIs & loan repayments

- Rent/housing loan

- Utilities

- Insurance premiums

- School/education fees

- Taxes/GST payments

Lifestyle / discretionary spending — More flexible:

- Dining out (Zomato/Swiggy)

- Shopping (Amazon, Flipkart, malls)

- Entertainment (movies, subscriptions beyond essentials)

- Travel & vacations

- Luxury items

- Frequent ATM cash withdrawals (often a red flag for uncontrolled spending)

By separating these two buckets, APIs help lenders answer:

- After fixed obligations, how much surplus is realistically available for new EMI?

- Is the applicant living within means or stretching with high lifestyle spend?

- Any signs of financial stress (e.g., frequent minimum credit card payments + high lifestyle outflows)?

Some advanced systems even calculate ratios like:

- Obligation-to-Income

- Discretionary-to-Total-Spend

- Surplus after obligations (average monthly credits minus recurring debits)

In short, expense categorization in 2026 has gone from basic tagging to deep behavioral insight. A solid Bank Statement Analyzer API doesn’t just tell you what was spent — it tells you what kind of spender the customer is, how committed their expenses are, and how much breathing room they truly have for new credit. That level of visibility is what powers fairer, faster, and lower-risk lending decisions today.

Cash Flow Analysis Explained

Cash flow analysis is where a Bank Statement Analyzer API really shows its value for lenders. Beyond just spotting income or tagging expenses, it looks at the bigger picture: how money actually moves in and out of the account over time. This reveals whether the applicant is living within their means, building savings, or slowly bleeding cash — all critical signals for credit risk and repayment capacity.

Monthly Cash Flow Calculation

Modern APIs break down the statement month-by-month (or even week-by-week for shorter periods), giving a clear view of financial health.

Total inflows vs outflows

For each month, the API sums:

- Inflows = All credits (salary, business receipts, interest, refunds, transfers in, etc.)

- Outflows = All debits (EMIs, rent, utilities, shopping, ATM withdrawals, etc.)

This gives a simple monthly snapshot:

- January 2025: Inflows ₹1,45,000 | Outflows ₹1,12,000

- February 2025: Inflows ₹1,38,000 | Outflows ₹1,25,000

The difference is the net cash flow for the month.

Net surplus/deficit analysis

Net surplus = Total inflows − Total outflows

- Positive surplus = Money left after expenses (potential for savings or new EMIs)

- Negative deficit = Spending more than earning (red flag for most lenders)

The API usually calculates:

- Average monthly surplus over the statement period

- Number of surplus months vs deficit months

- Trend: Is surplus growing, shrinking, or erratic?

A consistent positive surplus (especially after deducting recurring obligations) is one of the strongest green flags for loan approval.

Volatility tracking

Not all cash flow is steady. The API measures how much inflows and outflows swing month-to-month:

- Standard deviation or coefficient of variation of monthly inflows (low = stable salary, high = variable business income)

- Peak-to-trough differences (e.g., inflows drop 40% in one month → potential job loss or seasonal business dip)

- Sudden spikes in outflows (large one-off spends like medical or travel)

High volatility in inflows often leads lenders to apply conservative income estimates (e.g., take the lowest 3 months instead of the average).

Cash Flow Metrics Extracted

These are the key derived numbers that feed directly into credit decision engines.

Average monthly balance

Simple but powerful: the mean of end-of-month (or daily average) balances across the period.

- High and rising average balance = Good financial buffer

Low, declining, or frequently negative = Stress signal

- Many APIs also report minimum balance, maximum balance, and balance trend.

Cash burn rate

Especially useful for self-employed or startup founders (but increasingly applied to salaried too).

Burn rate = Average monthly outflows − Average monthly inflows (when negative)

Or more commonly: How many months of current expenses can be covered by average monthly surplus + current balance?

Example: If average surplus is ₹15,000/month and balance is ₹1,20,000 → ~8 months runway.

Income-to-expense ratio

Often expressed as:

- Total inflows ÷ Total outflows (ratio > 1.2–1.5 is healthy for most lenders)

Or more precisely: Net surplus ÷ Total inflows (savings rate)

- A low ratio (e.g., 1.05) means almost everything coming in is going right back out — little room for new debt.

Loan eligibility indicators

The API often computes or prepares data for these lender-specific rules:

FOIR (Fixed Obligation to Income Ratio) = Recurring EMIs + rent + other fixed obligations ÷ Average monthly income

- (Most lenders want <40–50%)

- Surplus for new EMI = Average monthly surplus after deducting existing obligations

- DSR (Debt Service Ratio) = Proposed new EMI ÷ Average monthly income

- Cash flow coverage = Average monthly surplus ÷ Proposed EMI (want >1.5×)

Many APIs return these as ready-to-use fields with confidence scores, so the loan origination system can apply hard rules or soft risk scoring instantly.

In 2026, cash flow analysis via Bank Statement Analyzer APIs has moved from a manual “gut feel” review to precise, data-driven metrics. It’s no longer just “do they have income?” — it’s “can they sustainably afford this loan without defaulting?” That shift is why instant approvals are possible for good applicants while risky ones get flagged early, all based on real transaction behavior rather than self-declared numbers.

Risk & Credit Insights from Bank Statement Analysis

In 2026, the real power of a Bank Statement Analyzer API isn’t just in telling you how much someone earns or spends — it’s in surfacing hidden risk signals that traditional credit scores often miss. Lenders use these APIs to go beyond surface-level numbers and spot patterns that scream “high risk” or “potential default” long before a missed EMI ever happens. Here are the key risk insights modern systems extract automatically.

Overdraft and Bounce Detection

Frequent overdrafts and cheque/EMI bounces are among the strongest early-warning signals.

What the API looks for:

- Transactions marked as “OD” (overdraft), “PENALTY”, “CHARGES FOR EXCESS”, “NEGATIVE BALANCE FEE”

- Negative balances even for short periods

- Returned cheques or failed auto-debits (“BOUNCE”, “RTRN”, “INSUF FUNDS”, “ECS RETURN”)

- Multiple instances of minimum balance penalty charges

Why it matters:

- Even one or two bounces in 6–12 months can double default risk

- Frequent overdrafts signal cash-flow stress or living beyond means

- APIs usually return:

- Count of bounces/overdrafts per month

- Total penalty charges incurred

- Days in negative balance

- A “bounce risk score” (high if ≥2 bounces or >₹5,000 in penalties over the period)

Many lenders set hard rules: >2 bounces in last 12 months → auto-decline or very high interest.

EMI Burden and Debt Exposure

The API doesn’t just spot existing EMIs — it quantifies how much of someone’s income is already locked up.

Key detections:

- Recurring debits to known NBFC/bank loan accounts (HDFC, Bajaj, Axis, Muthoot, etc.)

- Labels like “EMI”, “LOAN REPAY”, “CC PAYMENT”, “CREDIT CARD DUE”

- Credit card minimum payments (red flag for revolving debt)

- Multiple small recurring debits to different lenders (possible multi-lending)

Metrics extracted:

- Total monthly EMI/outgoing obligation amount

- FOIR (Fixed Obligation to Income Ratio) — usually want <40–50%

- Number of active loans detected

- Debt-to-income ratio (total obligations ÷ average monthly income)

- Trend: Is EMI burden increasing over time?

A common 2026 red line: FOIR >60% + declining surplus → very high risk, even if income looks decent on paper.

Gambling and High-Risk Merchant Detection

This category has exploded in importance as digital gambling and speculative trading apps have grown.

What gets flagged:

- Regular debits to known gambling platforms (“DREAM11”, “MY11CIRCLE”, “MPL”, “BETWAY”, international ones via UPI/international card)

- Frequent small-to-medium transfers to crypto exchanges or P2P trading accounts

- High-volume debits to “investment” apps with high-risk labels

- Patterns like many small debits to the same gaming/gambling merchant in short periods

How APIs catch it:

- Merchant name normalization + curated high-risk lists (updated frequently)

- Amount + frequency thresholds (e.g., >₹10,000/month to gambling merchants)

- Contextual clustering (many small losses + occasional large “win” credits)

Lenders increasingly treat consistent gambling/gaming spend as a major risk multiplier — often leading to rejection or significantly higher pricing.

Red Flags Lenders Watch in 2026

Beyond the big three, here are the other patterns that make underwriters pause:

- Sudden large cash deposits followed by quick withdrawals (possible layering/money mule behavior)

- Frequent large round-number transfers to unknown parties (potential cash cycling)

- Multiple salary credits from different companies in the same month (job-hopping or fake salary fabrication)

- High lifestyle spend with low/no surplus (spending every rupee that comes in)

- Frequent minimum credit card payments + high revolving balance

- Account dormancy followed by sudden activity (possible account takeover or mule activation)

- Very high ATM cash withdrawal ratio (>30–40% of outflows) — indicates opaque cash usage

- Income volatility with no clear business pattern (e.g., large irregular credits labeled vaguely)

- Multiple rejected loan/credit card applications visible as “enquiry” charges from various lenders

In practice, good APIs assign an overall risk score or risk tier (Low/Medium/High/Very High) by combining these signals with weighted rules and sometimes even lightweight ML models. A single strong red flag (like multiple bounces) can override good income, while clean behavior + consistent surplus can allow borderline applicants to get approved.

Bottom line: In 2026, bank statement analysis has become the most powerful risk filter in digital lending. It’s not about finding perfect customers — it’s about quickly spotting the ones who are statistically likely to default, while giving fair shots to those whose real cash flow tells a solid story. That combination of speed, depth, and accuracy is why these APIs are now non-negotiable infrastructure for any serious lender.

Key Use Cases of Bank Statement Analyzer APIs

In 2026, Bank Statement Analyzer APIs have become essential infrastructure across the entire financial ecosystem. What started as a niche tool for faster loan approvals has grown into a versatile building block for anything that needs to understand real money movement quickly, accurately, and at scale. Here are the main ways companies are putting these APIs to work today.

Lending & Credit Underwriting

This is still the #1 and most mature use case — the reason most of these APIs were built in the first place.

Instant loan approvals

The classic killer app. Customer uploads (or shares via Account Aggregator) 3–12 months of statements → API analyzes income, expenses, cash flow, and risk signals in seconds → decision engine approves or rejects instantly. No more waiting 2–7 days for manual verification. Many digital lenders now offer approvals in under 60 seconds for personal loans, with approval rates jumping 20–40% while keeping defaults in check thanks to better risk filtering.

MSME and SME lending

Small business lending is exploding, especially in markets like India. Business statements are messier (multiple accounts, cash deposits, irregular inflows), but good APIs handle it: detecting genuine business income vs personal, spotting seasonal patterns, calculating average monthly surplus for repayment, and flagging risky behaviors like frequent overdrafts. Lenders can now underwrite working capital loans, invoice financing, or term loans for shops, traders, and manufacturers in minutes instead of weeks.

BNPL and micro-loans

Buy Now, Pay Later players and micro-lenders love this because their ticket sizes are small (₹1,000–₹50,000), volumes are massive, and speed is everything. The API quickly checks if the applicant has stable enough inflows to handle even small EMIs without bouncing. It also catches serial defaulters across multiple BNPL providers by spotting overlapping EMIs. This has made “pay in 30 days” or “pay later in 3 installments” feel truly instant and low-friction.

Fintech & Personal Finance Apps

Beyond pure lending, consumer-facing fintech apps are using these APIs to deliver real value to users.

Expense tracking

Apps that connect to bank accounts (or let users upload statements) use the API to auto-categorize every transaction — groceries, dining, subscriptions, EMIs, rent — with merchant normalization and recurring detection. Users get beautiful dashboards showing where their money really goes, without manual tagging.

Financial health scoring

Some apps go further and compute a “financial fitness score” based on cash flow metrics: surplus consistency, obligation-to-income ratio, volatility, savings rate, bounce history. It’s like a personal CIBIL but based on actual behavior, not just credit history. Users love the actionable insights (“You have ₹12k surplus per month — you can afford that gym membership”), and it builds engagement.

Personalized insights

The API’s intelligence powers nudges and recommendations: “Your electricity bill spiked 40% last month — might be worth checking”, “You’re spending 22% on dining — here are cheaper alternatives”, “Your surplus is strong — ready to start an SIP?”. It turns raw data into hyper-personalized financial advice at scale.

Enterprise & SaaS Platforms

Larger players and B2B platforms embed these APIs as core features in their own products.

KYB and financial verification

Know Your Business processes are faster and deeper. SaaS platforms for vendor onboarding, trade credit, or corporate lending use the API to verify company financials from directors’ or business bank statements — checking real revenue, cash flow stability, and absence of red flags. It’s become a standard step in many digital KYB flows.

Fraud detection

Risk teams love the API for proactive fraud spotting: sudden large cash deposits + quick withdrawals (mule accounts), fabricated salary credits (multiple “salary” lines from unknown sources), gambling/high-risk merchant patterns, or inconsistencies in balance chains. Layering this with device + behavioral signals makes synthetic identity and first-party fraud much harder to pull off.

Account Aggregator integrations

In countries like India with Account Aggregator (AA) frameworks, the API is the perfect complement. AA gives consented, secure access to digital statements → Analyzer API parses, structures, enriches, and scores them. SaaS platforms building lending-as-a-service, embedded finance, or wealth management tools plug this combo in to offer end-to-end solutions without building their own document intelligence stack.

In short, by 2026, a Bank Statement Analyzer API isn’t a “nice-to-have” for fintechs anymore — it’s the engine behind instant decisions, smarter personal finance tools, safer enterprise onboarding, and lower-risk credit across the board. Whether you’re approving a ₹5,000 micro-loan or verifying a ₹50 crore business, these APIs have become the fastest, most reliable way to turn messy bank data into trustworthy financial truth.

Which response do you prefer?

This will help make Grok better.

Response A

Accuracy, Security & Compliance in 2026

When lenders and fintechs rely on a Bank Statement Analyzer API for instant credit decisions, two things become non-negotiable: the data has to be accurate enough to trust with real money, and the whole process has to be secure and compliant with the strictest regulations. In 2026, the bar for both has risen sharply — regulators, customers, and partners expect near-perfect performance and ironclad protection.

OCR Accuracy Benchmarks

Accuracy isn’t just a nice-to-have metric anymore; it directly impacts default rates and approval fairness. Here’s what top-tier Bank Statement Analyzer APIs are delivering in early 2026:

Field-level accuracy on clean digital PDFs (net-banking downloads): 98.5–99.7%

- Almost every date, amount, narration, and balance is extracted correctly.

Field-level accuracy on mobile photos / scanned statements (real-world uploads): 94–97.5%

- Even blurry, angled, low-light shots or faded printouts hit this range thanks to preprocessing + layout-aware models.

End-to-end transaction categorization & income classification accuracy: 92–96%

- After parsing + ML enrichment, most transactions land in the correct bucket (salary, rent, EMI, gambling, etc.) with high confidence.

- Balance chain consistency rate: >98% of statements pass full opening-to-closing balance verification without manual correction needed.

Benchmarks come from internal fintech reports, third-party audits, and public leaderboards (when vendors share them). Leading APIs now publish “real-world accuracy” dashboards showing performance across 50+ Indian banks + international formats. Anything below 94% on messy inputs is considered outdated — lenders simply won’t integrate it.

When accuracy dips (rare edge cases like handwriting, extreme distortion, or very old statements), good APIs return per-field confidence scores (0–100%) so the decision engine can route low-confidence documents for light human review or reject outright.

Data Encryption and Access Control

Security starts the moment a file hits the API.

- In-transit encryption: All uploads/downloads use TLS 1.3 (mandatory in 2026). No plaintext ever touches the wire.

- At-rest encryption: Files and extracted data are encrypted using AES-256 (or better) with keys managed via cloud KMS (AWS KMS, Google Cloud KMS, or equivalent). Keys are rotated regularly.

- Access control:

- Role-based access (RBAC) — only authorized API keys can call endpoints

- Per-customer isolation — each tenant’s data lives in logically separate environments

- Zero-trust architecture — every request is authenticated, authorized, and audited

- IP whitelisting + API key + JWT tokens for sensitive operations

Most providers now offer end-to-end customer-controlled encryption options: you upload encrypted files, provide the key only during processing, and the API never stores the plaintext long-term.

RBI, GDPR, ISO, SOC Considerations

Compliance isn’t optional — it’s table stakes for operating at scale in 2026.

RBI Guidelines (India-specific but influential globally):

- Full adherence to RBI’s Master Directions on Digital Lending, Account Aggregator framework, and Master Direction on IT Governance

- Data localization (critical customer data stored in India)

- Consent management aligned with AA protocol

- Audit trails for every statement processed

GDPR / DPDP Act (India’s Digital Personal Data Protection Act 2023, fully enforced by 2026):

- Lawful processing with explicit consent

- Data minimization — only extract what’s needed for the stated purpose

- Right to erasure and data portability

- Breach notification within 72 hours

ISO & SOC Certifications (industry standard):

- ISO 27001:2022 — Information Security Management System

- SOC 2 Type II — Controls for security, availability, processing integrity, confidentiality, privacy (most serious vendors have this)

- Some go further: ISO 27701 (privacy), ISO 31000 (risk management)

Vendors typically display these badges prominently and provide compliance reports/SOC 2 attestations on request. Lenders often require proof during vendor onboarding.

Secure Data Retention and Deletion Policies

The best APIs follow strict “process-and-purge” models:

- No long-term storage by default — statements are processed in memory or temporary secure storage and deleted immediately after analysis (often within minutes)

- Retention only when required — if kept for audit/dispute (e.g., 90 days), it’s encrypted, access-logged, and automatically purged

- Customer-controlled deletion — APIs offer endpoints to delete all processed data for a user instantly

- Audit-proof logging — Every access, process, and deletion is logged immutably for compliance audits

Many providers now give zero-retention modes for ultra-sensitive use cases — the file is processed ephemerally and nothing is persisted beyond the response.

In 2026, a Bank Statement Analyzer API that can’t prove high accuracy, bulletproof security, and full regulatory alignment simply doesn’t get integrated. The combination of near-perfect extraction + ironclad data handling is what lets lenders approve loans in seconds while sleeping well at night — knowing they’re making decisions on clean, secure, and compliant data.

Why AZAPI.ai Is a Strong Choice in 2026

If you’re building or scaling anything that involves understanding real bank statements in India — especially in lending, fintech, or embedded finance — AZAPI.ai has quietly become one of the most reliable and forward-looking Bank Statement Analyzer APIs available in 2026. Here’s why teams keep choosing (and sticking with) it.

High OCR Accuracy for Indian Bank Statements

Indian bank statements are notoriously tough: scanned passbooks, blurry mobile photos, multi-page PDFs from 50+ banks, watermarks, stamps, varying layouts, and cryptic UPI narrations. AZAPI.ai was built specifically for this reality.

Their OCR + document understanding pipeline delivers field-level accuracy that consistently ranks among the top in real-world Indian benchmarks:

- 99.91%+ on clean digital PDFs from net-banking

- 99%+ on typical smartphone photos and scanned statements (the ones customers actually upload)

- Very strong handling of regional banks, cooperative banks, small finance banks, and older formats that trip up more generic/global solutions

What really sets it apart is the low rate of balance chain breaks — almost every statement passes opening-to-closing verification with minimal corrections. That means fewer false declines, fewer manual reviews, and more confident automated decisions.

Advanced Income and Cash Flow Detection

This is where AZAPI.ai really shines for credit underwriting.

The income detection engine is fine-tuned on massive Indian datasets, so it reliably picks up:

- Salary credits (with excellent employer name normalization across IT giants, manufacturing, and SMEs)

- Business inflows (UPI collections, cash deposits, client transfers)

- Government benefits (PM-KISAN, DBT, pensions)

- Interest and other recurring credits

Cash flow analysis goes deep:

- Precise monthly surplus/deficit calculation

- Volatility scoring that separates stable salaried profiles from seasonal/variable business ones

- FOIR and repayment capacity metrics ready for your decision engine

- Strong recurring obligation detection (EMIs, rent, utilities)

Lenders report significantly better risk separation — approving more good applicants while catching risky ones earlier — compared to older or less India-specific tools.

Developer-Friendly APIs

AZAPI.ai was designed by developers, for developers.

You get:

- Clean, well-documented REST API with clear endpoints (upload → analyze → get JSON)

- SDKs for Node.js, Python, Java, and mobile (React Native/Flutter wrappers)

- Webhooks for async processing (great for high-volume)

- Sandbox environment with sample statements for testing

- Detailed error codes and per-field confidence scores

Integration time is usually hours to a couple of days, not weeks. And the API is forgiving — it handles password-protected PDFs, multi-file uploads, and even partial statements gracefully.

Scalable for Startups and Enterprises

Whether you’re a early-stage fintech doing 100 applications a day or a large NBFC processing thousands, AZAPI.ai scales without drama:

- Pay-as-you-go pricing that starts affordable for startups

- Enterprise plans with dedicated support, SLAs, custom models, and volume discounts

- High throughput (no artificial throttling for legitimate use)

- Auto-scaling infrastructure that handles spikes (like festive season loan rushes)

Many teams start small, prove ROI quickly, and then upgrade seamlessly as volume grows — without rewriting code or switching vendors.

Use Cases Across Lending, Fintech, and SaaS

AZAPI.ai powers a wide range in 2026:

- Digital lenders doing instant personal loans, micro-loans, and BNPL

- MSME/SME platforms offering working capital and invoice financing

- Personal finance apps providing expense tracking and financial health scores

- SaaS platforms embedding financial verification for KYB, vendor onboarding, or trade credit

- Account Aggregator-integrated flows (they play very nicely with AA data)

Teams love that the same API handles personal, business, and even some NRI/international statements with strong accuracy, so you don’t need multiple vendors.

Bottom line? In 2026, when speed, accuracy, and risk control are make-or-break for digital finance in India, AZAPI.ai stands out as a pragmatic, high-performance choice. It’s not the flashiest name in every marketing deck, but among the builders who actually ship and scale — it’s one of the most trusted tools in the stack. If your product depends on truly understanding Indian bank statements at scale, it’s very hard to go wrong with AZAPI.ai.

Conclusion

In 2026, the financial services landscape has changed in ways that were hard to imagine just a few years ago. What used to be a slow, manual, paperwork-heavy process—reviewing bank statements, verifying income, assessing risk—has been completely transformed by Bank Statement Analyzer APIs.

These APIs deliver a powerful combination of benefits that are now table stakes for staying competitive:

- Lightning-fast processing — turning messy uploads into structured, enriched data in seconds

- Near-human (and often super-human) accuracy on Indian bank statements, even the blurry photos and scanned passbooks that real customers actually provide

- Deep, intelligent insights — reliable income detection, precise cash flow analysis, recurring obligation tracking, expense categorization, and sophisticated risk flagging

- Strong fraud and red-flag detection that catches issues traditional credit scores miss

- Rock-solid security, compliance (RBI, DPDP, SOC 2, etc.), and developer-friendly integration that scales from 100 to 100,000+ applications per day

The result? Lenders approve more good customers faster, reduce defaults, cut operational costs, and create genuinely delightful user experiences. Personal finance apps give users meaningful visibility into their money habits. SaaS platforms embed powerful financial verification without building everything from scratch.

Why Bank Statement Analyzer APIs are essential in 2026

Simply put: real bank transaction data is the single most truthful, up-to-date, and hard-to-fake source of financial behavior available. In an era of instant expectations, rising loan volumes, increasing digital fraud, and stricter risk controls, relying on self-declared income documents, outdated credit reports alone, or slow manual reviews is no longer viable.

The APIs that can accurately read, understand, and score these statements in real time have become the critical infrastructure layer — like payment gateways or KYC APIs a decade ago. You either have this capability built in (or integrated seamlessly), or you’re falling behind.

Final thoughts for fintechs and developers

If you’re building anything that touches lending, credit, personal finance, embedded finance, or business verification in India today — stop treating bank statement analysis as a “nice-to-have” or something you can hack together with open-source OCR. The difference between mediocre and market-leading products often comes down to how well you understand the actual money movement of your users.

The teams that win in 2026 will be the ones who treat this capability as core product infrastructure: fast, accurate, secure, and continuously improving.

Ready to level up your product?

Give AZAPI.ai a try — their Bank Statement Analyzer API is built exactly for the Indian reality of 2026, with exceptional accuracy, smart insights, and developer experience that makes integration painless.

Head over to azapi.ai to sign up for a free trial, test with your own sample statements, or book a quick demo to see how it fits your use case.

The future of finance is already here — and it starts with truly understanding the bank statement.

FAQs:

1. What is a Bank Statement Analyzer API?

Ans: A Bank Statement Analyzer API is an AI-powered service that automatically reads, extracts, structures, and analyzes data from bank statements (PDFs, scans, photos, net-banking exports). It turns messy financial documents into clean JSON with categorized transactions, income detection, cash flow metrics, expense breakdown, and risk flags — all in seconds. This powers instant loan approvals, credit scoring, and financial insights without manual review.

2. How accurate are Bank Statement Analyzer APIs for Indian bank statements in 2026?

Ans: Top APIs achieve 97–99%+ field-level accuracy on clean digital PDFs and 94–97% on real-world mobile photos/scans. For Indian statements (with UPI narrations, regional banks, watermarks, and varying layouts), specialized solutions like AZAPI.ai consistently hit 99.19% in benchmarks, especially on balance chain verification and income classification. Generic/global tools often fall short on local formats.

3. Which banks and formats does a good Bank Statement Analyzer API support?

Ans: Leading APIs support 100+ Indian banks (including SBI, HDFC, ICICI, Axis,

- regional/cooperative/small finance banks) and handle:

- Digital PDFs & net-banking exports

- Scanned printouts & mobile photos

- Password-protected files

- Multi-page statements

- CSV/Excel/TXT exports No need for bank-specific templates — the best ones use AI trained on

- millions of real Indian statements.

4. How does a Bank Statement Analyzer API help in instant loan approvals?

Ans: It automates the slowest part of underwriting:

- Extracts & verifies salary/business income

- Calculates monthly surplus, FOIR, repayment capacity

- Flags bounces, overdrafts, gambling, high-risk spends

- Delivers structured data + risk score in 5–30 seconds Result: Personal loans, micro-loans, BNPL,

- and MSME credit approvals drop from days to minutes while keeping defaults low.

5. Can it detect fraud or manipulated bank statements?

Ans: Yes — advanced APIs use metadata analysis, font inconsistencies, tampering detection, balance chain mismatches, and suspicious pattern flagging (sudden large cash deposits, layering, fake salary credits). AZAPI.ai and similar tools provide authenticity scores and clear fraud indicators to prevent bad loans.

6. Is it secure and RBI-compliant?

Ans: Reputable APIs are fully compliant with RBI digital lending guidelines, DPDP Act, GDPR principles, SOC 2 Type II, and ISO 27001. Features include:

- End-to-end encryption (TLS 1.3 + AES-256)

- Data localization in India

- Zero/long-term retention options

- Consent-based processing

- Immutable audit logs Always ask for latest compliance reports during evaluation.

7. How much does a Bank Statement Analyzer API cost?

Ans: Pricing is usually pay-as-you-go (₹5–50 per statement analyzed, depending on volume & features). Startups get affordable entry plans; enterprises get volume discounts, SLAs, and dedicated support. Most providers (including AZAPI.ai) offer free trials, sandbox testing, and no upfront fees.

8. How long does it take to integrate a Bank Statement Analyzer API?

Ans: Developer-friendly APIs integrate in hours to a few days. You get:

- REST endpoints + SDKs (Node.js, Python, Java, etc.)

- Webhooks for async processing

- Clear docs & sample code

- Sandbox with test statements AZAPI.ai is especially praised for fast, painless integration even for high-volume lending platforms.

9. What’s the difference between basic OCR and a full Bank Statement Analyzer API?

Ans: Basic OCR just reads text → high error rates on tables/narrations.

- A full Analyzer API adds:

- Layout-aware extraction

- ML-based categorization (salary vs business income, EMI vs rent)

- Cash flow & risk analytics

- Fraud detection

- Confidence scores & explainable outputs For real lending decisions, the full analyzer is essential.

10. Which is the best Bank Statement Analyzer API for Indian lending in 2026?

Ans: It depends on your use case, but AZAPI.ai frequently ranks at the top for Indian fintechs and lenders because of:

- Exceptional accuracy on messy local statements

- Strong MSME/salaried income & cash flow detection

- Excellent fraud/risk flagging

- RBI-compliant security

- Easy scaling from startup to enterprise volume Many teams run pilots and choose it for the best balance of performance, speed, and support.