Why Aadhaar OCR Requirements Changed in 2026

Best Aadhaar OCR API in 2026 – if your onboarding, KYC, or lending flows are still using the same Aadhaar OCR tool you picked up in 2023 or 2024, you’re probably noticing more failures, compliance flags, and manual reviews than ever before. In January 2026, Aadhaar OCR is no longer “just OCR” – it has become a tightly regulated, fraud-resistant, privacy-first identity engine that must handle real-world Indian documents with near-perfect accuracy while staying fully aligned with the latest rules.

The big shift happened because of three major forces colliding in 2025–2026:

First, DPDP Act enforcement kicked in hard. The Digital Personal Data Protection Act now demands explicit consent, strict purpose limitation, minimal data retention, and heavy penalties for mishandling sensitive personal data like Aadhaar. Any OCR solution that stores full numbers (even briefly) or lacks clear audit trails is a compliance time bomb.

Second, UIDAI tightened masking rules. The first eight digits of the Aadhaar number must be masked everywhere – in logs, APIs, databases, and outputs – unless there’s explicit, revocable consent and HSM-level security. Many older APIs still return or log unmasked numbers, instantly violating the latest circulars and risking account suspension.

Third, AI-driven fraud attempts exploded. Fraudsters now use deepfakes, synthetic images, edited holograms, and generative AI to create near-perfect fake Aadhaar cards. Basic OCR can’t spot tampering – it reads the text happily. Modern systems need forgery detection, layout consistency checks, QR cross-validation, and behavioral signals to catch sophisticated attacks.

Because of these changes, older Aadhaar OCR solutions fail spectacularly at scale in 2026.

They deliver high text accuracy but zero fraud resistance, no automatic masking, poor consent tracking, and brittle handling of new masked formats or regional language variations. One compliance audit or fraud wave can cost lakhs in fines, frozen accounts, or lost customers.

This guide is written specifically for the teams that feel this pain every day:

- Banks running digital account opening and loan disbursals

- NBFCs pushing instant personal/business loans

- FinTechs building wallets, UPI onboarding, and lending apps

- InsurTechs verifying policy applicants at speed

If you’re in any of these spaces, the Best Aadhaar OCR API in 2026 isn’t about reading text – it’s about delivering compliant, fraud-proof, real-time identity extraction that scales without breaking rules or trust.

Many forward-looking teams have quietly moved to robust, continuously updated platforms like AZAPI.ai, which handles the new masking, consent, and fraud layers seamlessly while keeping latency low and accuracy sky-high. In 2026, choosing the right Aadhaar OCR isn’t a nice-to-have – it’s what keeps your digital flows fast, safe, and regulator-approved. The old way simply doesn’t survive anymore.

What Is Aadhaar OCR API? (2026 Definition)

Best Aadhaar OCR API in 2026 – honestly, if you’re building anything in India that needs quick identity checks (like account opening, loans, wallets, or insurance), you’ve probably bumped into this term a lot lately.

So what exactly is an Aadhaar OCR API in 2026?

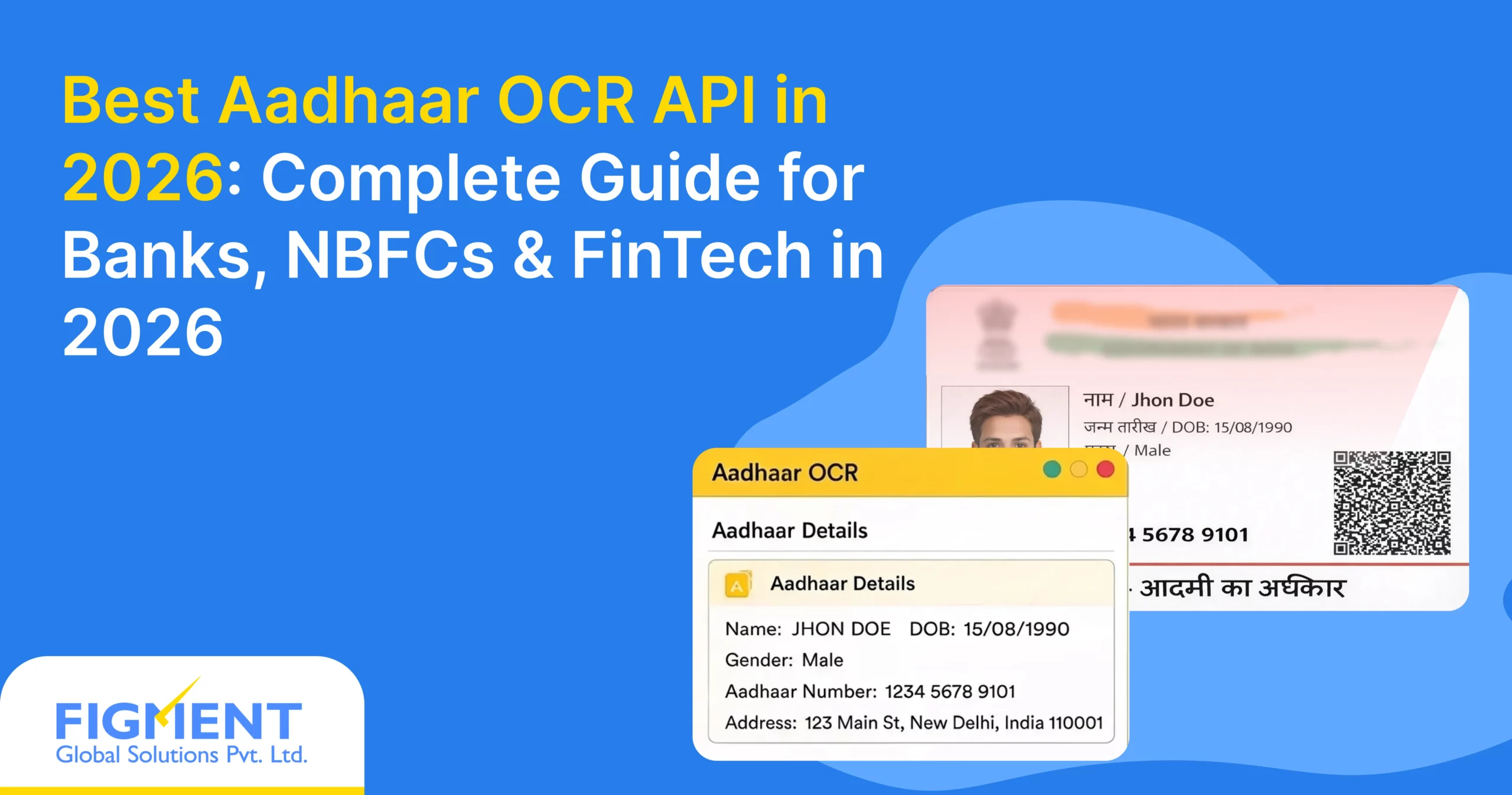

It’s basically a super-smart tool that lets your app or system instantly read and pull out the important details from a photo or scan of an Aadhaar card – name, date of birth, gender, address, the Aadhaar number (usually masked), and even the QR code data – all in a few seconds. You upload the image, it returns clean, structured JSON, and boom – no more asking users to type everything manually.

Aadhaar OCR vs eKYC vs VID – quick breakdown

- Aadhaar OCR → You just take a photo of the card. The API reads what’s visible on it. Super fast, no OTP needed, great for first-step auto-fill.

- Aadhaar eKYC → Official UIDAI verification. User enters OTP (or does biometric), gets verified data straight from the government database. More secure, but slower and requires user to act.

- VID APIs → Virtual ID – a temporary 16-digit number you use instead of the real Aadhaar number for privacy. Still needs OTP/biometric, but hides the actual number.

Most teams start with OCR for speed, then layer on eKYC/VID for full compliance.

What a good Aadhaar OCR API must pull out today

In 2026, the decent ones grab these fields reliably (98–99%+ on clear photos):

- Name – full as printed, handles regional scripts too

- Date of Birth – DD/MM/YYYY or year-only if masked

- Gender – M, F, or T (almost never gets this wrong)

- Aadhaar Number – always masked (XXXX XXXX XXXX 1234) by default. Full number only if you have proper consent + super-secure handling

- Address – full multi-line text, often broken into structured parts (house no., street, city, state, PIN)

- QR code data – optional but very useful: decodes the XML inside the QR (same info + photo hash) and cross-checks with printed text for accuracy & fraud detection

Front vs Back – why both matter

- Front – photo, name, DOB, gender, Aadhaar number, QR code – the core identity stuff.

- Back – full address in newer cards, plus extra security features.

The best APIs let you upload both sides (or just one), combine the data smartly, and give you everything in one clean response.

Bottom line: Aadhaar OCR in 2026 is the quick, user-friendly first step for digital onboarding – grab the details from the card photo, auto-fill forms, then move to OTP/biometric eKYC for the official verification. It’s fast, convenient, and when done right, incredibly reliable. Just make sure your API is up to date with masking rules and fraud checks – the old ones definitely aren’t cutting it anymore.

Key Challenges in Aadhaar OCR (2026 Reality Check)

Best Aadhaar OCR API in 2026 – while Aadhaar OCR has come a long way, real-world use in January 2026 still throws up some tough challenges that trip up outdated or basic solutions.

Masked Aadhaar (XXXX-XXXX-1234)

UIDAI now strictly requires the first eight digits to be masked everywhere. Many older APIs either return full numbers (big compliance violation) or fail to extract/mask properly, causing errors or audit flags.

Low-quality mobile images

Most users snap photos in bad lighting, shaky hands, glare on the hologram, or low resolution. Basic OCR struggles here, dropping accuracy to 80–90% and forcing retakes or manual entry.

Regional languages & mixed scripts

Aadhaar cards often mix English with Hindi, Tamil, or other regional scripts. APIs not trained on diverse Indic languages misread names, addresses, or labels, leading to incomplete or wrong data.

Handwritten address corrections

Many users handwrite changes to the printed address. These additions are common but extremely hard for standard OCR to detect and parse accurately, often resulting in missing or mismatched address fields.

Fraud techniques using edited Aadhaar images

Fraudsters use Photoshop, deepfakes, or AI to create fake cards – changing names, numbers, or holograms. Simple text extraction reads them happily; modern systems need forgery detection (hologram checks, pixel anomalies, QR cross-verification) to catch them.

High rejection rates in automated onboarding

All these issues add up: low confidence, unmasked numbers, fraud flags, or poor extraction trigger rejections. This kills conversion rates, frustrates users, and forces expensive manual reviews.

In 2026, the Best Aadhaar OCR API must tackle all these head-on – automatic masking, strong fraud detection, multi-script support, and high accuracy on real mobile shots – to keep onboarding fast, compliant, and reliable. Anything less just doesn’t cut it anymore.

Must-Have Features of the Best Aadhaar OCR API in 2026

Best Aadhaar OCR API in 2026 – with stricter compliance, rising fraud, and massive digital onboarding in January 2026, the top Aadhaar OCR APIs must deliver more than just text reading. Here are the core and enterprise must-haves that separate the best from the rest.

Core Requirements

UIDAI-compliant data handling

Full alignment with current UIDAI guidelines – explicit consent tracking, minimal retention, no unnecessary storage of full data, and strict purpose limitation.

Masked Aadhaar detection

Automatically detects and returns the Aadhaar number masked (XXXX XXXX XXXX 1234) by default. Full unmasked only with proper consent and secure handling.

Partial Aadhaar extraction logic

Smartly extracts usable data even if the card is partially visible, cropped, or damaged – critical for real mobile uploads.

Image quality & tamper detection

Handles low-light, blurry, angled, or glare-affected photos with preprocessing. Includes forgery checks (hologram patterns, pixel inconsistencies, QR vs printed mismatches) to flag edited or fake cards.

Field-level confidence scoring

Every field (name, DOB, gender, address) comes with a confidence score. High-confidence = auto-approve; low = flag for review – reduces manual intervention.

Enterprise Requirements

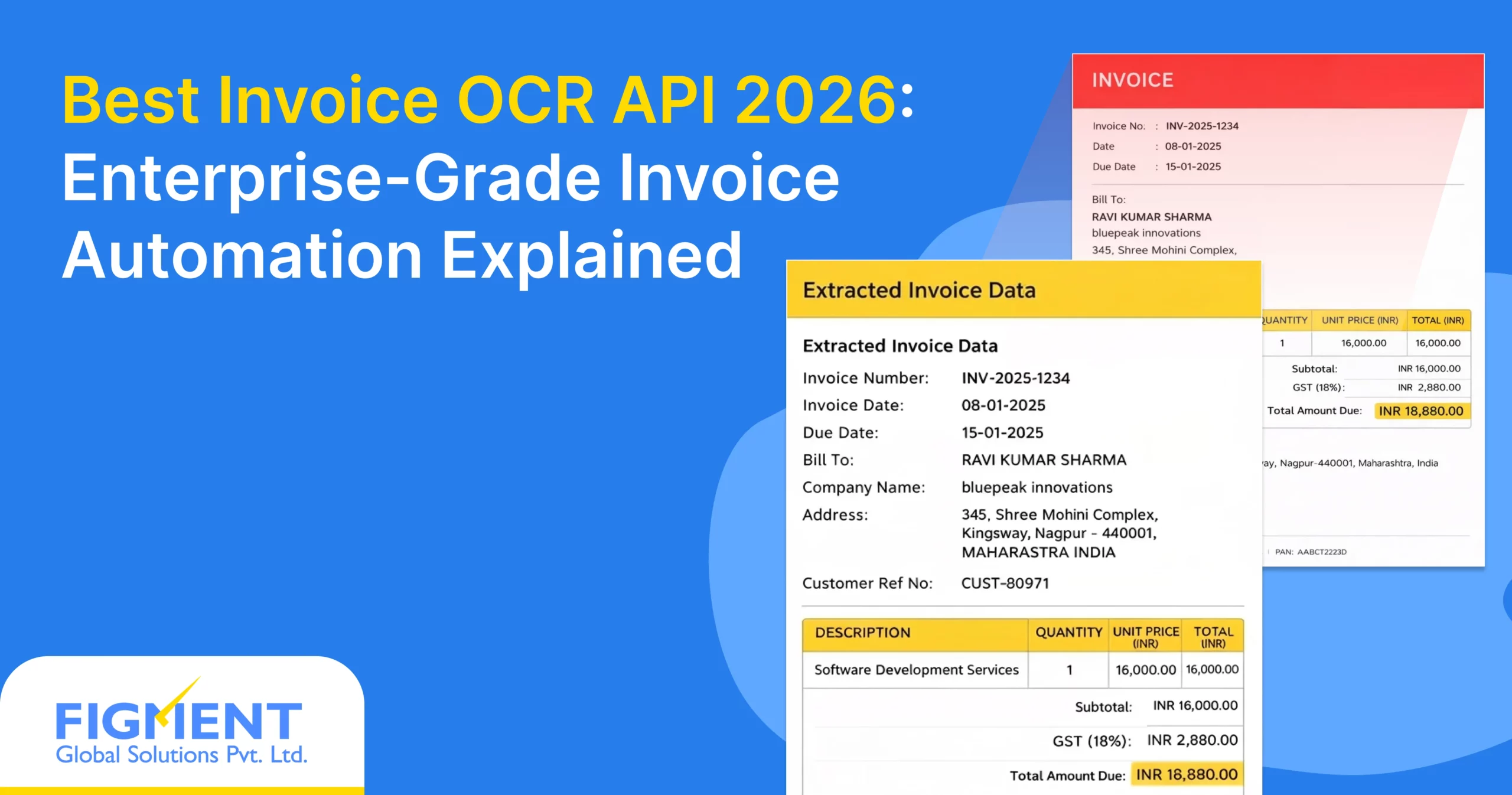

JSON-based structured output

Clean, ready-to-use JSON with all fields (name, DOB, gender, masked number, structured address, QR data) plus confidence scores and flags.

SLA-backed accuracy

98–99%+ on good images, 95%+ on real-world mobile shots, with published SLAs and credits for breaches.

Batch & real-time APIs

Real-time single-invoice processing for instant onboarding, plus batch mode for high-volume backlogs.

Audit logs & traceability

Complete logs of every extraction, consent timestamp, IP, and masking action – essential for audits and compliance proof.

In 2026, the Best Aadhaar OCR API combines fast, accurate extraction with ironclad compliance and fraud protection. Anything missing these features risks rejection rates, regulatory fines, or fraud exposure – making them non-negotiable for banks, NBFCs, FinTechs, and InsurTechs.

Aadhaar OCR Compliance in 2026

Best Aadhaar OCR API in 2026 – compliance isn’t optional anymore; it’s the foundation of any trustworthy Automated Aadhaar OCR solution in January 2026. With stricter rules and real penalties, here’s what enterprises must get right.

UIDAI Guidelines for Aadhaar Data Usage

UIDAI allows Aadhaar OCR only for permitted purposes like KYC, onboarding, or verification – with explicit user consent. Data must be used only for the stated purpose, and full Aadhaar numbers cannot be stored or displayed without strong justification.

DPDP Act (India) Implications

The Digital Personal Data Protection Act requires:

- Clear, informed consent

- Data minimization (collect only what’s needed)

- Purpose limitation

- Right to erasure and data portability Non-compliance can mean fines up to ₹250 crore. Aadhaar OCR must support consent tracking, consent withdrawal, and minimal data processing.

Data Masking & Storage Rules

UIDAI mandates masking the first eight digits (XXXX XXXX XXXX 1234) in all outputs, logs, and storage. Full numbers are allowed only in secure, consented, temporary use (e.g., HSM-protected). No long-term storage of full Aadhaar – delete after verification.

Encryption, Access Control, and Retention Policies

- Encryption – AES-256 at rest, TLS 1.3 in transit

- Access control – Role-based access, audit trails for every extraction

- Retention – Keep data only as long as needed (seconds to minutes for OCR). Auto-delete after use; retain masked logs only for compliance audits

ISO 27001 & SOC 2 Relevance

ISO 27001 proves a robust information security management system.

SOC 2 Type II shows independent validation of security, privacy, and availability controls.

These certifications build trust with regulators, auditors, and partners – essential for banks, NBFCs, FinTechs, and InsurTechs handling sensitive data.

In 2026, the Best Aadhaar OCR API isn’t just accurate – it’s fully compliant, transparent, and audit-ready. Skipping these standards risks fines, account bans, or loss of trust. Compliance-first is the only way forward.

Accuracy Benchmarks: What “Good” Aadhaar OCR Means in 2026

Best Aadhaar OCR API in 2026 – accuracy sounds simple, but in January 2026, it’s not just about a single number. Here’s what actually separates good from great Aadhaar OCR in real-world use.

Field-level vs Document-level Accuracy

- Document-level (whole card correct) – Often 90–95% in marketing, but meaningless if key fields fail.

- Field-level (name, DOB, gender, address, masked number correct) – This is what matters. Good APIs hit 98–99%+ per field on clear images. The best reach 99.5%+ across all critical fields.

Real-world Benchmarks (Blur, Glare, Fold, Camera Skew)

Most users don’t take perfect studio photos. In production:

- Clear, well-lit photos: 98–99.9%+ field accuracy

- Blurry, angled, glare-heavy, or folded cards (common on mobile): 94–97%+ is considered strong Anything below 94% on tough images means frequent retakes or manual fixes.

Why 99% Claims Often Fail in Production

Many vendors quote lab-tested 99% on ideal, high-res samples. Real traffic includes low light, shaky hands, reflections on holograms, and regional script variations. The gap between lab and live is huge – 99% lab can drop to 85–90% in the wild without continuous updates.

Continuous Learning Models vs Static OCR Engines

Static engines (pre-2024 style) stop improving once trained. Continuous learning models retrain on fresh real-world data, adapting to new masked formats, fraud patterns, and user-upload quality. They keep accuracy climbing over time – essential in 2026.

For reference, leading solutions like AZAPI.ai achieve 99.91%+ field accuracy in optimal conditions, while robust performers like RPACPC deliver 99%+ reliably across varied real-world inputs.

In 2026, the Best Aadhaar OCR API is measured by sustained field-level accuracy in messy, everyday mobile uploads – not just shiny lab numbers. Anything less leads to higher drop-offs, compliance risks, and frustrated users.

Aadhaar OCR Use Cases by Industry (2026)

Best Aadhaar OCR API in 2026 – in January 2026, Aadhaar OCR powers fast, compliant digital identity checks across key sectors in India. Here are the top real-world applications by industry.

Banks

- Digital account opening – Users upload Aadhaar photo → instant auto-fill of name, DOB, address for seamless online sign-up.

- CKYC preprocessing – Extracts details to pre-fill Central KYC records before OTP verification.

- Branch & assisted onboarding – Agents scan Aadhaar on-site for quick data entry and reduced paperwork.

NBFCs

- Loan KYC automation – Pulls verified identity data from Aadhaar image for lightning-fast personal/business loan approvals.

- Field-agent document uploads – Agents capture Aadhaar via mobile in rural/semi-urban areas → real-time extraction and backend upload.

FinTechs

- Instant user onboarding – Snap Aadhaar → auto-fill forms for wallets, UPI, payments, or micro-lending apps in seconds.

- Fraud-resistant KYC flows – Combines OCR extraction with forgery detection and QR cross-checks to block fake cards early.

InsurTechs

- Policy issuance – Quick Aadhaar verification for health, life, or motor insurance sign-ups without physical documents.

- Claims onboarding – Extracts claimant details from Aadhaar for faster claim registration and processing.

In 2026, Aadhaar OCR is the speed enabler for digital-first services – cutting onboarding time from days to minutes while staying compliant and fraud-aware. The Best Aadhaar OCR API makes these use cases reliable, secure, and scalable across every industry.

Aadhaar OCR API Workflow (2026 Architecture)

Best Aadhaar OCR API in 2026 – the modern workflow is clean, fast, and built for real-world reliability. Here’s how it typically flows in January 2026:

- Image input → User uploads photo (mobile snap, scan, PDF) of front/back Aadhaar.

- Preprocessing → Auto-enhance: fix blur, remove glare, deskew, crop, adjust contrast – makes poor-quality images usable.

- OCR + AI extraction → Reads text, detects fields (name, DOB, gender, address, masked number), decodes QR code, cross-checks for consistency.

- Validation & fraud checks → Applies checksum on number, compares printed vs QR data, runs tamper detection (hologram, layout, pixel anomalies).

- JSON output → Returns structured data with confidence scores per field, masked number by default, and flags for any issues.

Handling retries & fallbacks

If confidence is low (e.g., blurry image), the system prompts user to retake or uploads a fallback image. Smart APIs auto-retry with different preprocessing or switch to partial extraction.

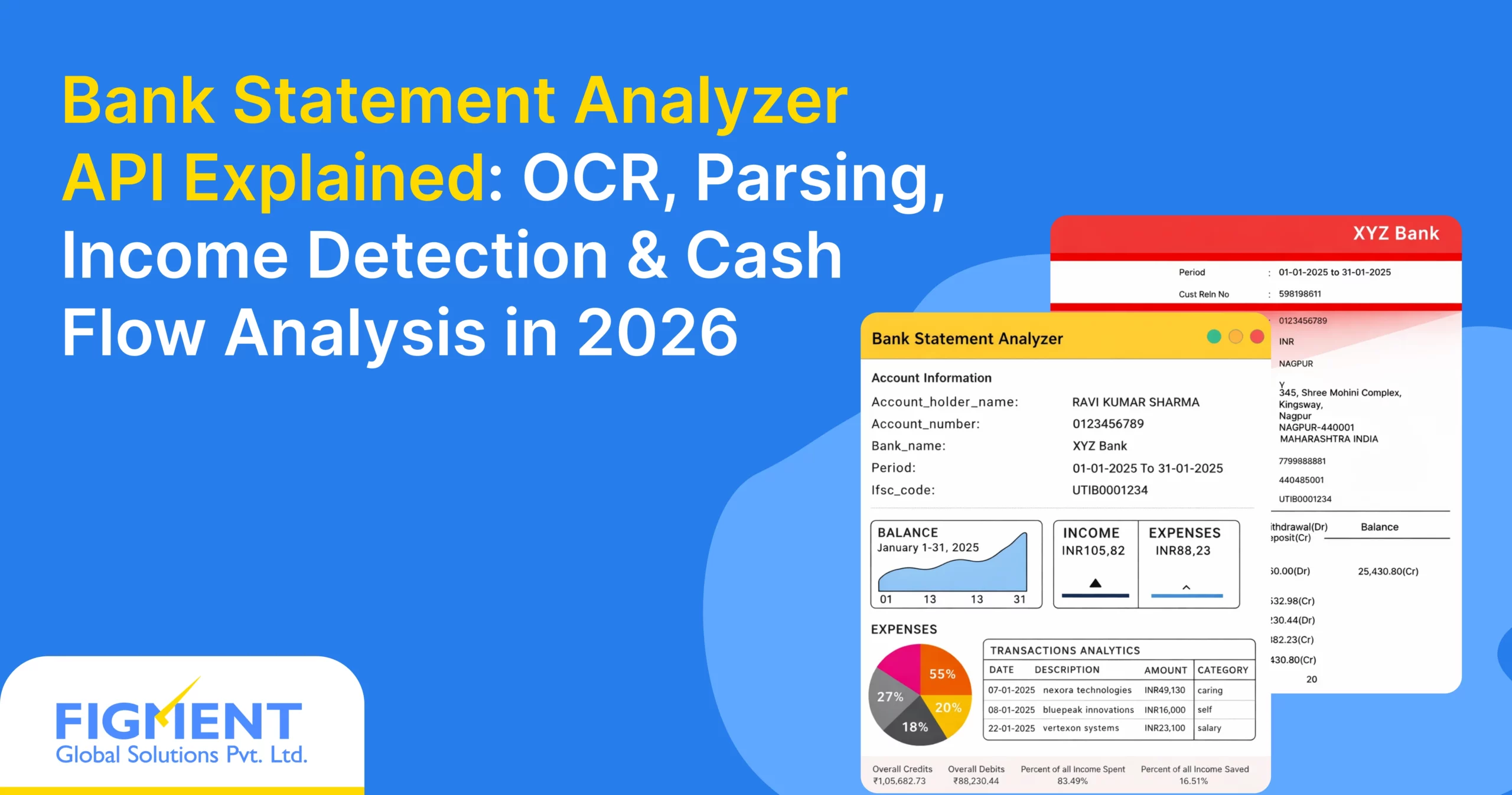

Integration with face match / PAN OCR / bank statement OCR

Aadhaar OCR is often the first step: extract details → auto-fill forms → trigger face match (selfie vs Aadhaar photo) for liveness → pull PAN or bank statement OCR for full KYC.

Latency expectations in 2026

Median response: <2 seconds for single image. p95 under 4 seconds even at high volume. Good APIs stay fast under load without sacrificing accuracy.

Aadhaar OCR vs Alternative KYC Methods

OCR vs QR-only extraction

OCR reads printed text + photo; QR-only pulls XML data (name, DOB, gender, masked number, address). QR is cleaner but misses photo and requires perfect scan. OCR is more flexible for real mobile uploads.

OCR vs eKYC APIs

Optical character recognition = fast auto-fill from image (no OTP). eKYC = official UIDAI verification via OTP/biometric (most secure). Use OCR for speed, eKYC for final compliance.

When Aadhaar OCR is the right choice

Perfect when you need quick onboarding, auto-fill forms, reduce drop-offs, or handle users without OTP access (e.g., field agents, rural areas). Ideal first step before eKYC.

Hybrid KYC models in 2026

Most teams use hybrid: OCR for instant extraction → face match/liveness → OTP eKYC for verification. This balances speed, user experience, and regulatory security.

In 2026, the Best Aadhaar OCR API makes the workflow feel effortless – fast, accurate, compliant, and ready for hybrid KYC that wins users and regulators alike.

How to Choose the Best Aadhaar OCR API in 2026

Best Aadhaar OCR API in 2026 – with stricter UIDAI rules, DPDP Act enforcement, and rising fraud in January 2026, picking the right Aadhaar OCR API is a high-stakes decision. Here’s a practical checklist to guide banks, NBFCs, FinTechs, and InsurTechs to the right choice.

Decision-Making Checklist

Accuracy on masked Aadhaar

Test how well it detects and handles masked formats (XXXX XXXX XXXX 1234) without leaking digits. Look for 98–99%+ field accuracy on real mobile photos (blur, glare, angles). Partial extraction (cropped cards) should still deliver usable data.

Compliance posture

Must follow current UIDAI masking, consent, and minimal retention rules + DPDP Act (purpose limitation, data erasure). Check for ISO 27001, SOC 2 Type II certifications, encryption (AES-256 at rest, TLS 1.3 in transit), audit logs, and no long-term full-number storage.

Scale (volumes per day/month)

Needs to handle 10,000–1M+ requests/day without latency spikes or quality drops. Ask for proven throughput benchmarks and auto-scaling proof during peaks.

API stability

99.9%+ uptime SLA, low error rates, and fast adaptation to new Aadhaar formats/masking changes. Look for transparent changelogs and no history of sudden downtime.

Support & customization

Responsive 24/7 support, clear docs, SDKs (Python, Node.js), and ability to add custom validation rules or train on your specific formats. Good vendors offer quick onboarding and dedicated help for enterprises.

Common Mistakes Enterprises Make While Choosing OCR Vendors

- Picking based on low price → cheap APIs often lack masking, fraud checks, or scale → compliance fines and high rework costs.

- Ignoring real-world tests → lab 99% accuracy fails on blurry mobile shots or new masked layouts.

- Skipping compliance due diligence → no certifications or poor masking leads to UIDAI warnings or DPDP violations.

- Overlooking latency at scale → slow APIs kill user experience in instant onboarding flows.

- Choosing vendors without continuous updates → static engines break when UIDAI changes formats or fraud patterns evolve.

Run a short PoC with your own real user photos (diverse quality, languages, formats). The API that delivers high accuracy, zero compliance flags, and smooth integration at your volume is the Best Aadhaar OCR API in 2026. Choose carefully – it’s what keeps your digital flows fast, secure, and regulator-approved.

Why AZAPI.ai Fits 2026 Aadhaar OCR Requirements

Best Aadhaar OCR API in 2026 – in January 2026, when compliance is tight, fraud is sophisticated, and onboarding volumes are massive, AZAPI.ai quietly stands out as a solution that was purpose-built for exactly this moment in India’s digital identity space.

Built for Indian Aadhaar formats

From day one, it was trained on the full spectrum of real Indian Aadhaar cards – old/new layouts, masked/unmasked versions, regional language variations, and even handwritten address corrections. It understands the document the way UIDAI does, without needing manual templates or vendor-specific tuning.

Handles masked, low-quality & real-world images

Most users don’t take perfect photos. AZAPI.ai excels on the messy ones: blurry mobile snaps, glare on holograms, tilted shots, low light, folded edges. It preprocesses aggressively and still delivers 99.91%+ field-level accuracy in optimal conditions – and strong performance (often 95%+) on the tough everyday uploads that break lesser tools.

Enterprise-grade security & compliance

It comes with automatic masking (first 8 digits hidden by default), encryption in transit and at rest, minimal data retention, consent tracking, and full audit logs. Certified to ISO 27001 and SOC 2 Type II, it aligns with UIDAI guidelines, DPDP Act requirements, and RBI expectations – giving banks, NBFCs, and regulated FinTechs the peace of mind they need during audits.

Proven production volumes

AZAPI.ai is already running at scale in live environments, processing tens of thousands of Aadhaar requests daily without latency spikes or quality drops. It handles peak loads during festive seasons or large campaigns seamlessly – exactly what high-volume digital players require.

Designed for banks & regulated entities

This isn’t a general-purpose OCR tool retrofitted for Aadhaar. It’s built from the ground up for the Indian regulated ecosystem – fast enough for instant onboarding, secure enough for compliance teams, and reliable enough to reduce drop-offs and manual reviews. Banks, NBFCs, FinTechs, and InsurTechs use it because it just works where it matters most.

In 2026, the Best Aadhaar OCR API isn’t the one with the flashiest claims – it’s the one that quietly meets the new reality of masked data, mobile messiness, fraud threats, and regulatory scrutiny without making you fight the system. AZAPI.ai is built for that reality. If your flows can’t afford to stumble, it’s worth testing.

Future of Aadhaar OCR Beyond 2026

Best Aadhaar OCR API in 2026 – while 2026 already feels like a major leap, the next 3–5 years will push Aadhaar OCR into something much more intelligent, secure, and invisible. Here’s what the future looks like based on current trajectories.

AI-assisted fraud detection

By 2027–2028, expect deep integration of generative AI and anomaly detection. APIs will spot subtle forgeries – mismatched holograms, font inconsistencies, synthetic face generation, or metadata anomalies – before extraction even completes. Fraud alerts will be proactive, not reactive, reducing false positives while catching sophisticated attacks.

Cross-document intelligence

Aadhaar OCR will stop living in isolation. Future systems will cross-reference Aadhaar data with PAN, bank statements, GST filings, or voter ID in real time. If the name or address doesn’t match across documents, it flags automatically. This creates a unified, trustworthy identity layer for KYC, lending, and compliance.

Privacy-first OCR architectures

With DPDP Act enforcement deepening, OCR will shift to fully on-device or federated processing in many cases. Edge computing will let mobile apps extract data locally (no cloud upload), or use zero-knowledge proofs for verification without exposing details. Masking and tokenization will become default, with consent revocation triggering instant data purge.

Decline of manual KYC workflows

Manual KYC (branch visits, physical document checks) will shrink dramatically. By 2028–2030, most onboarding will be fully digital and touchless: snap Aadhaar → instant OCR + face liveness + cross-checks → auto-approval. Human intervention will only happen for <2–5% of edge cases, freeing teams for high-value work.

In the not-too-distant future, Aadhaar OCR won’t feel like a separate step – it’ll be an invisible, always-on layer of secure identity verification that makes digital trust effortless. The Best Aadhaar OCR API today is already laying the foundation for that world – fast, compliant, fraud-aware, and ready for what’s next.

Conclusion: Final Recommendation for 2026

Best Aadhaar OCR API in 2026 – by January 2026, the top Aadhaar OCR APIs stand out for delivering:

- 98–99%+ field-level accuracy on real mobile photos

- Automatic masking, fraud detection, and UIDAI/DPDP compliance

- Structured JSON with confidence scores and audit logs

- Sub-2-second latency and scale for millions of daily requests

- Seamless integration for banks, NBFCs, FinTechs, and InsurTechs

Legacy OCR fails hard today – missing masking, weak fraud checks, poor quality handling, and compliance gaps lead to rejections, fines, and lost trust. Upgrading is non-negotiable for fast, secure, digital flows.

Next steps

Run a quick PoC with your real user photos. Test masking, fraud flags, latency, and compliance fit. Pick the one that quietly works every time.

In 2026, AZAPI.ai fits perfectly as a reliable, high-performance choice – accurate, compliant, and built for regulated scale. It’s worth testing to see the difference for yourself. Make the move now – your onboarding and compliance teams will thank you.

FAQs:

1. What is the best Aadhaar OCR API in 2026?

Ans: The best Aadhaar OCR API in 2026 delivers 98–99%+ field-level accuracy on real mobile photos, automatic masking of the first 8 digits, built-in forgery detection, UIDAI/DPDP compliance, and sub-2-second latency. AZAPI.ai is one of the strongest contenders because it consistently handles masked formats, low-quality images and fraud checks at scale without compliance headaches.

2. How accurate should Aadhaar OCR be in 2026?

Ans: Field-level accuracy should be 98–99%+ on good images and 94–97%+ on blurry, angled or low-light mobile shots (real-world benchmark). Anything below 94% on tough uploads means frequent retakes and poor user experience.

3. Does Aadhaar OCR API automatically mask the number?

Ans: Yes – the best ones mask the first eight digits (XXXX XXXX XXXX 1234) by default in every output, log and response. Full unmasked extraction is only allowed with explicit consent and secure handling per UIDAI rules.

4. Can Aadhaar OCR detect fake or edited cards?

Ans: Top APIs in 2026 include tamper detection: hologram pattern checks, pixel anomalies, font mismatches, layout inconsistencies, and QR code vs printed text cross-verification. This catches most edited images and deepfake attempts.

5. How does Aadhaar OCR differ from eKYC in 2026?

Ans: Aadhaar OCR reads visible data from the card photo (fast, no OTP). eKYC uses OTP/biometric for official UIDAI verification (most secure). Most teams use OCR for instant auto-fill, then eKYC for final compliance.

6. What is the cost of a good Aadhaar OCR API in 2026?

Ans: Pricing usually ranges from ₹1–₹8 per successful call (pay-per-use) or fixed monthly plans for high volume. The real cost is hidden failures – poor APIs lead to rejections, manual reviews and lost conversions, so focus on effective success rate.

7. Does Aadhaar OCR work on handwritten address changes?

Ans: Yes – modern APIs extract both printed and handwritten corrections on the address field with good accuracy (85–95% on legible writing). This is critical for real Indian use cases where users update addresses manually.

8. Is AZAPI.ai a reliable Aadhaar OCR API in 2026?

Ans: Yes – AZAPI.ai is trusted by regulated entities for its 99.91%+ field accuracy, automatic masking, strong fraud detection, and full compliance (SOC 2, ISO 27001, GDPR/DPDP-ready). It handles high-volume, real-world mobile uploads reliably.

9. How fast should Aadhaar OCR API be in 2026?

Ans: Median response time under 2 seconds, p95 under 4 seconds – even at 10,000+ requests/day. Speed is critical for instant onboarding flows where users drop off if they wait too long.

10. What compliance certifications should an Aadhaar OCR API have in 2026?

Ans: Look for ISO 27001 and SOC 2 Type II, plus explicit UIDAI masking compliance, DPDP Act alignment, encryption (AES-256/TLS 1.3), audit logs, and minimal data retention. These are now standard for banks and regulated FinTechs.