Global Solutions Pvt. Ltd.

Global Solutions Pvt. Ltd.

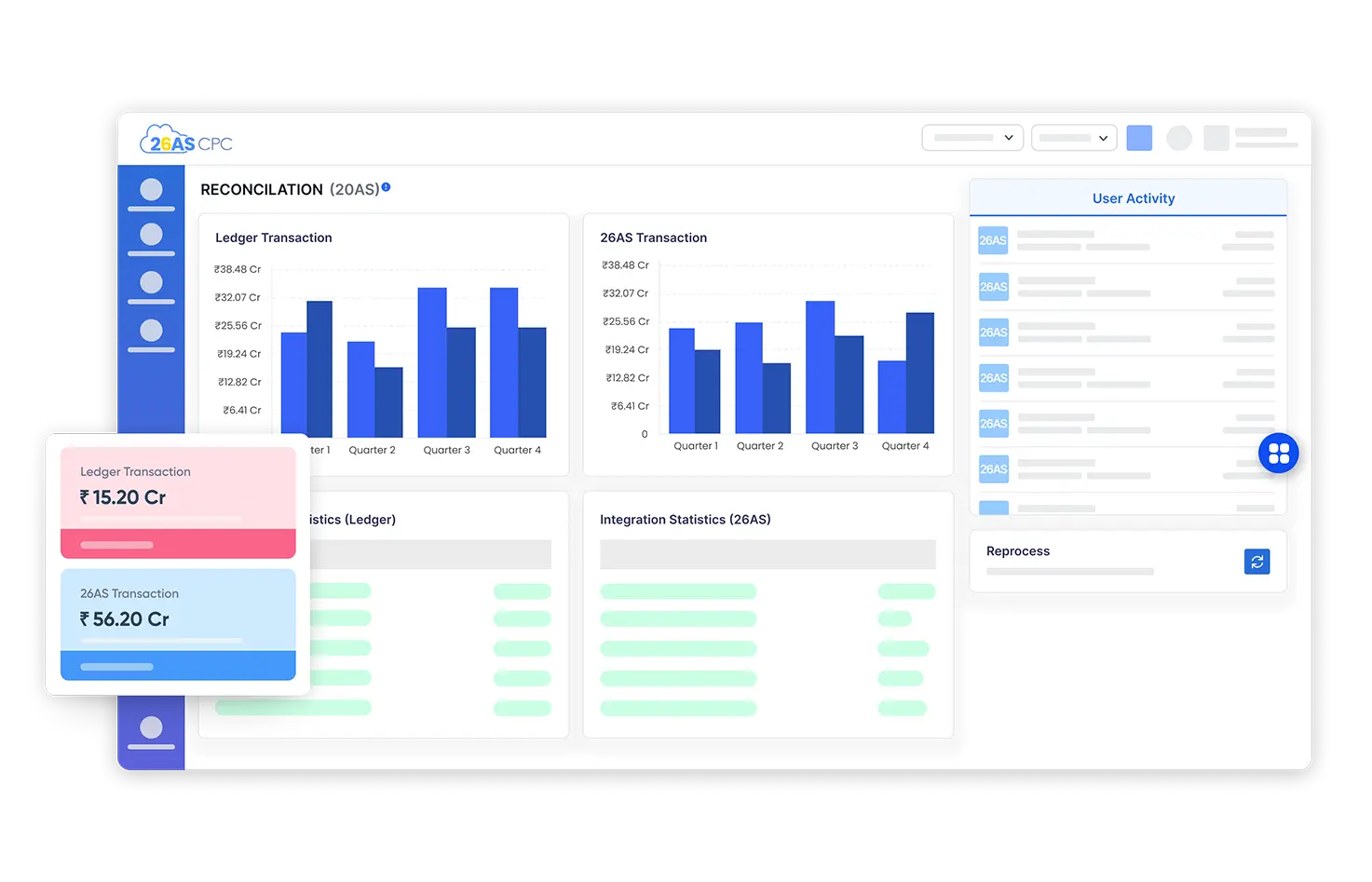

26ASCPC is an advanced, centralized reconciliation tool designed to streamline the 26AS reconciliation process for organizations, ensuring compliance and efficiency. It automates the matching of TDS credits reported in 26AS with books of accounts or ERP data, reducing manual intervention and errors.

Built for scalability, 26ASCPC helps enterprises handle large volumes of data with ease, providing detailed reports, variance identification, and actionable insights. The platform supports seamless data import, real-time tracking, and automated alerts to ensure timely resolutions and accurate filings.

Whether you’re managing reconciliation for hundreds or millions of PANs, 26ASCPC simplifies the process, saves time, and ensures 100% traceability—empowering finance teams to close books faster and stay audit-ready.

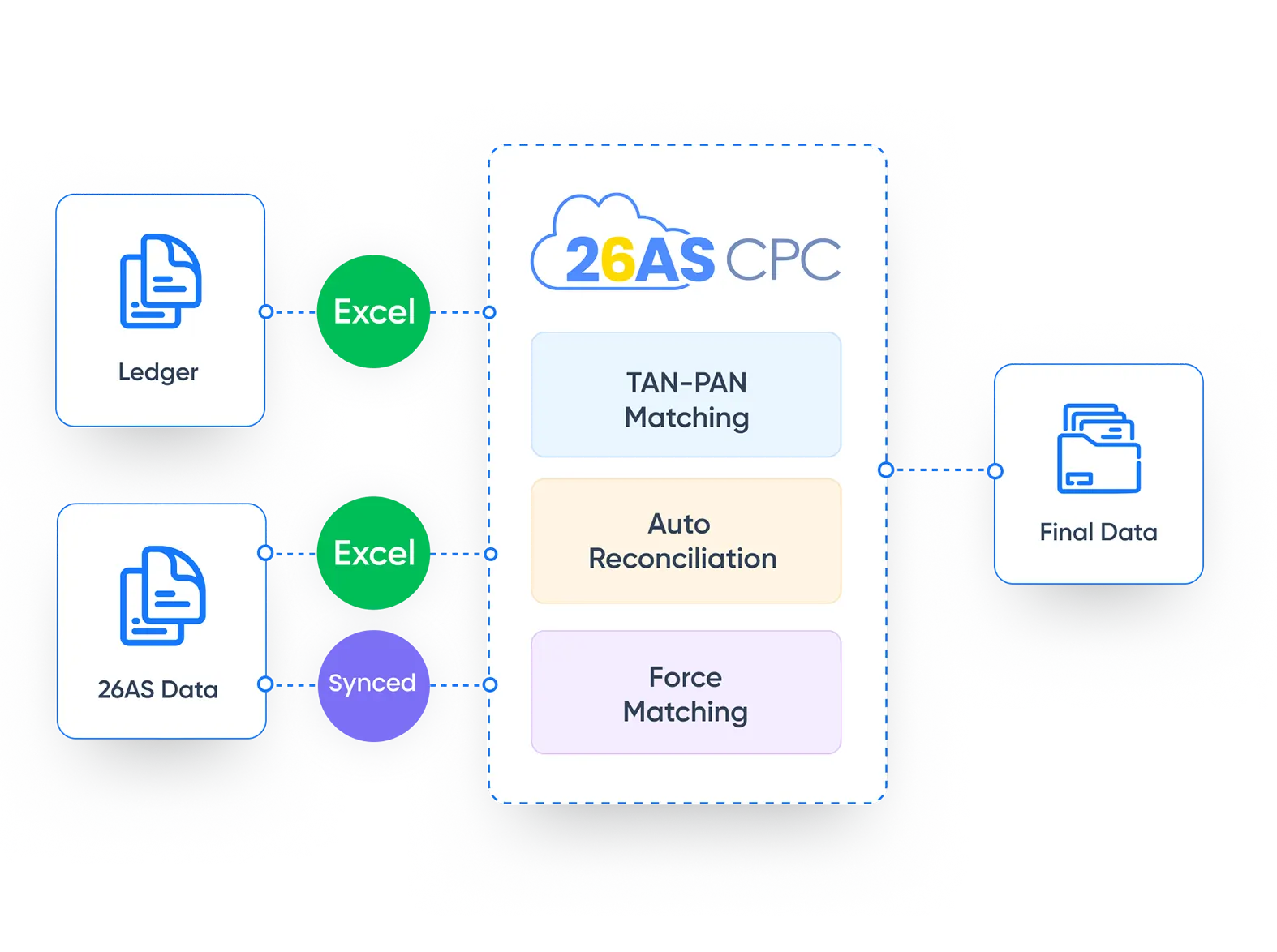

Extracts and verifies PANs for all TANs in Form 26AS. Ensures name validation and eligibility classification for accurate TDS mapping.

Performs Exact, Range, and Fuzzy Logic matching to align 26AS with books. Includes “Forced Acceptance” and generates detailed match reports.

Real-time updates with multi-entity support and compliance adaptability. Easily adjusts to tax regulation changes and operational structures.

Generate detailed reconciliation summaries and classification reports in just a few clicks. Empowers teams with accurate insights and ready-to-export data for internal audits or client reviews.

Enterprises, tax professionals, CA firms, & corporates managing large volumes of TDS, invoice, or PAN-TAN reconciliation data.

Ideal for teams handling complex tax data workflows, frequent 26AS validations, or high-volume compliance operations.

Also suitable for shared service centers and outsourcing firms seeking centralized, automated reconciliation solutions.

Whether you manage internal records or client data, 26ASCPC ensures accuracy, speed, and audit readiness.

26ASCPC provides smart solutions for enterprises to simplify their tax filing 24*7

Built on a robust and scalable architecture, 26ASCPC uses advanced processing logic, including 'Forced Acceptance' and intelligent flagging mechanisms to detect, categorize, and track unmatched records with precision—ensuring end-to-end transparency in reconciliation.

Harnesses 100+ fuzzy logic parameters to intelligently match vendor names, invoice numbers, TDS amounts, and dates—even in cases of spelling errors or data mismatches. This reduces dependency on manual verification and increases match accuracy.

The platform is highly configurable to suit diverse client workflows, formats, and compliance structures. Whether you’re a growing business or a large enterprise, 26ASCPC adapts to your specific reconciliation needs.

Automatically flags discrepancies, partial matches, and anomalies for user review. Helps teams prioritize issues and reduce time spent on clean-up.

Generate detailed reconciliation and exception reports in just a few clicks. Stay prepared for internal reviews, client audits, or tax assessments.

Supports reconciliation across multiple branches, divisions, or clients simultaneously. Handles high volumes of data with speed and accuracy.

0+

0+

0+

0M+