What is a TAN Number?

TAN stands for Tax Deduction and Collection Account Number.

- It’s a 10-character alphanumeric code issued by the Income Tax Department of India.

- Example: NGPA12345A

- Mandatory for anyone (individuals, companies, government bodies, etc.) who is required to deduct or collect tax at source under the Income Tax Act, 1961.

Purpose of TAN

- Identify the Deductor/Collector — Similar to how PAN identifies taxpayers, TAN identifies entities responsible for TDS (Tax Deducted at Source) or TCS (Tax Collected at Source).

- Quote in TDS/TCS Returns — Must be mentioned in all TDS/TCS returns, certificates, challans, and correspondence with the Income Tax Department.

- Track TDS Payments — Helps CPC (Centralized Processing Cell) match tax deducted with the relevant payee’s PAN in Form 26AS.

What is TRACES?

TRACES = TDS Reconciliation Analysis and Correction Enabling System.

- It’s an online portal maintained by the Income Tax Department (https://www.tdscpc.gov.in)

- It allows deductors, collectors, and taxpayers to view TDS/TCS data, file corrections, download forms, and reconcile statements.

Why Register TAN on TRACES?

Registering your TAN on TRACES is mandatory for a deductor to:

- Download Form 16/16A (TDS Certificates for employees/vendors)

- View Form 26AS details for deductees

- File correction statements for TDS returns

- Check challan status and link challans to deductions

- Submit requests for justification reports, refund status, and consolidated files

- Respond to notices related to short deductions, late filings, etc.

Without registration, you cannot access these services online — meaning you’d be stuck with physical requests and delays.

Step-by-Step Breakdown

1. Visit TRACES and Begin Registration

- Go to the official TRACES portal at www.tdscpc.gov.in and click “Register as New User”.

- Choose “Deductor” as your user type and click Proceed.

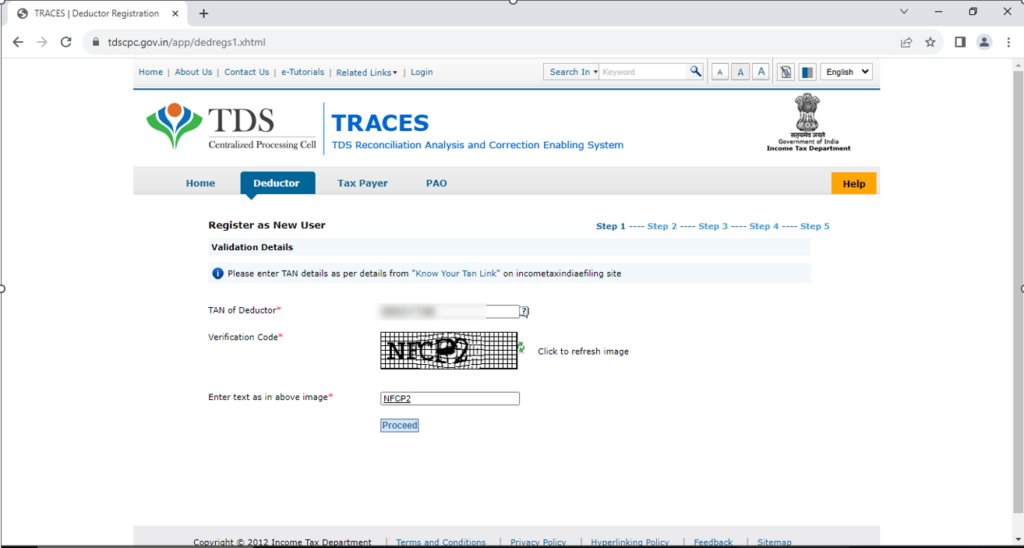

2. Enter TAN and CAPTCHA

- Provide your TAN and the on-screen verification captcha code, then click Proceed.

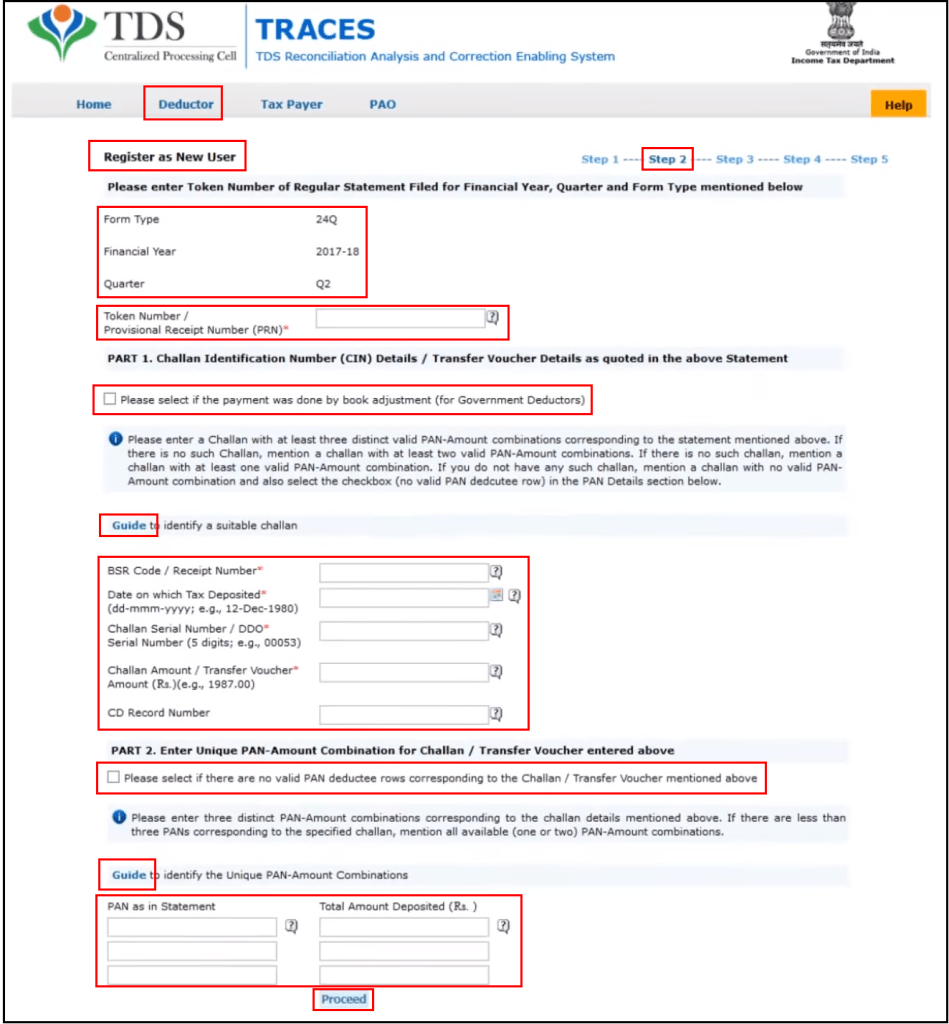

3. KYC Validation Using Statement Details

- The system auto-populates fields like Financial Year, Quarter, and Form Type.

- Manually enter the Token Number from a processed, non-nil TDS statement corresponding to the pre-filled fields.

- Provide CIN/BIN details and select corresponding PAN–amount combinations using the “Guide to” feature.

Note: Statements must be processed at CPC and not nil—unprocessed or nil entries will result in errors.

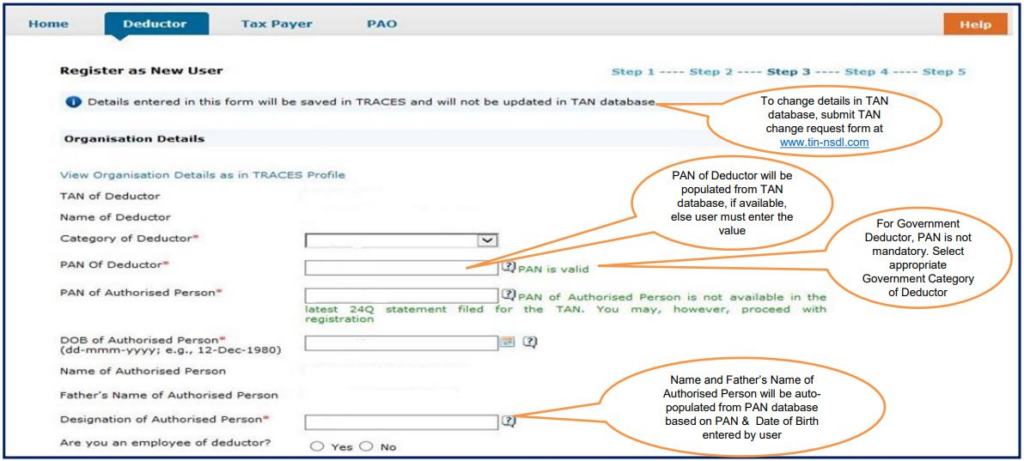

4. Enter Organization & Contact Details

- Provide details such as:

- Category of Deductor

- PAN of Deductor (not required for government deductors)

- PAN, Date of Birth, Name, and Designation of the Authorized Person

- Choose whether to fetch your address and communication details from TAN Master or your last filed statement.

5. Create User ID & Password

- Set a User ID and a strong password (8–14 characters, with uppercase/lowercase, numbers, and optional special characters like &, comma, semicolon).

6. Confirm Submission

- Review all entered details on the confirmation screen. Use the Edit option if changes are needed, then click Confirm to submit.

7. Account Activation

- After submitting, you’ll receive:

- An email with an activation link and Activation Code 1

- SMS with Activation Code 2

- Click the activation link and enter both codes to activate your account. Note: Activation must occur within 48 hours, or the request will expire.

Quick Fix: If codes expire but still fall within the 48-hour window, re-enter your TAN in step 1 and click Submit—the system will prompt to resend the codes.

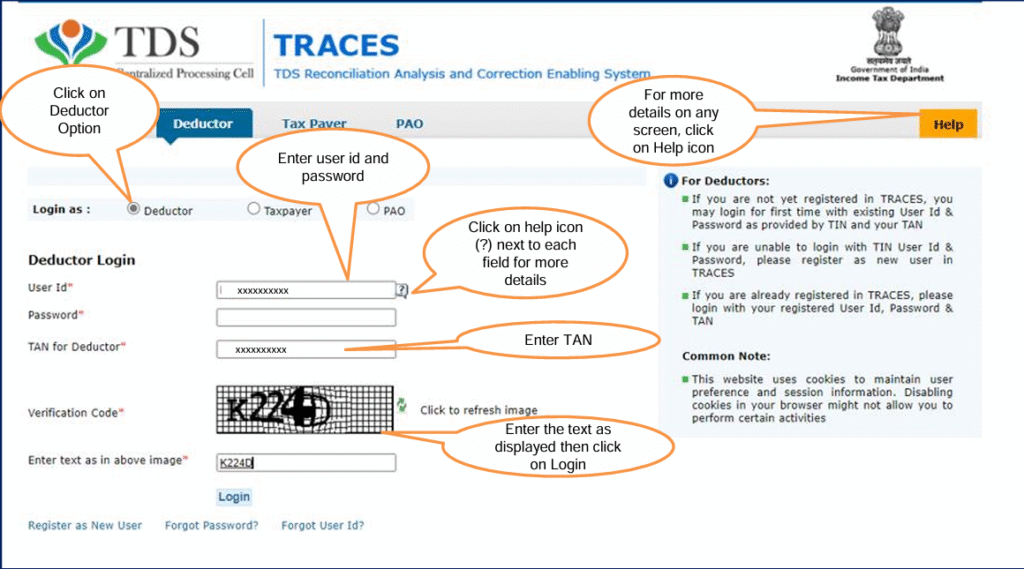

8. Login to Your Account

- Once activated, log in to the portal using your User ID and password along with TAN and the captcha or verification code.

Summary Table

| Step | Action Summary |

| 1 | Access TRACES portal → Select “Deductor” |

| 2 | Enter TAN and CAPTCHA |

| 3 | Complete KYC: Token, CIN/BIN, PAN–amount combos |

| 4 | Input organization & communication details |

| 5 | Create User ID + strong password |

| 6 | Confirm all entries on the summary screen |

| 7 | Activate account via email link + codes (within 48 hrs) |

| 8 | Login and access TRACES features |