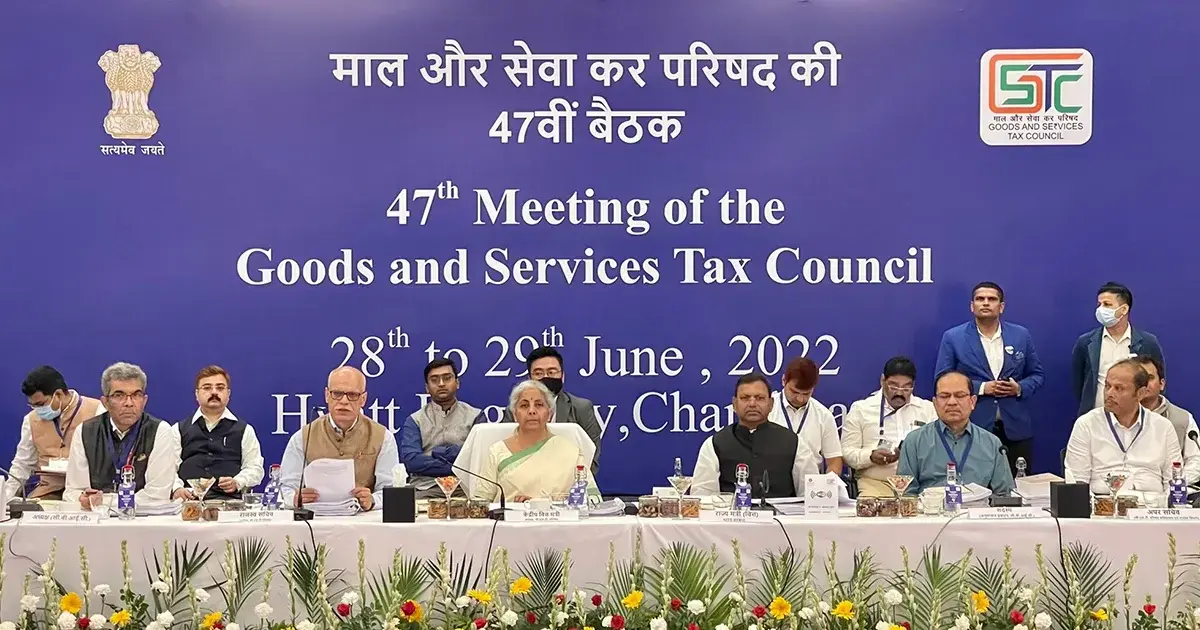

Key outcomes of the 47th GST Council meeting for TaxCPC – Unit of Figment Global Solutions page readers with its likely impact on the stakeholders.

Mandatory Registration For Small Online Sellers Waved – Giving a leg up to the unorganized sector, the Council agreed that From January 1, 2023, online sellers with an annual turnover of Rs 40 lakh or Rs 20 lakh– in the case of small and select states– will be exempt from mandatory registration under GST. The move is expected to benefit 120,000 small traders. Currently, small offline sellers are exempted from compulsory registration

Compensation To States – At the time of the implementation of GST, the Centre had decided to compensate the states for any loss of revenue from the new tax for five years which ends on June 30. Several states, mostly ruled by the opposition, have been demanding an extension of GST compensation, citing two years of the pandemic. However, the GST Council did not take any call on it, and will likely be taken up again in the next meeting.

Correction In The Inverted Duty Structure -The council has accepted the recommendation by the group of ministers on correcting the inverted duty structure. A host of items now attract higher GST like LED lamps, ink, knives, blades, power-driven pumps, and dairy machinery will attract 18% GST. Higher than the existing 12%. Further. The GST rate on solar water heaters and finished leather was hiked from 5% to 12%.

Online Gaming, Casinos, And Horse Racing – Earlier reports suggested that there could be a 28% GST on this, treating them on par with gambling. The council decided to further deliberate on the tax rate and the method of valuation of taxation on such services. *On the rationalization of tax rates, the council has not taken up the issue and a ministerial panel. Has been given three months’ time to submit its report.

Proposal To Withdraw Tax Exemptions On A Few Items Along With Rate Changes On a Few Others

Exemptions has also been removed on a variety of services including hotels with a rent below Rs 1,000 a day. Hospital room rents (excluding ICU) above Rs 5,000 per day and services provided by RBI, Irdai and Sebi.

The council also wants all post office services, other than postcards and inland letters. book posts, and envelopes weighing less than 10 gm, to be taxed. However, goods that are unpacked and unlabelled are still exempt from GST.

Relief To The Transport Sector – By slashing rates on transport by ropeways and renting of truck/goods carriage where the cost of fuel is included.

On Movement Of Gold And Precious Stones Under The E-Way Bill – The council has allowed states to decide on the threshold above which e-way bill can be generated. The ministerial panel has recommended a threshold of Rs 2 lakh and above.

The GST council has also decided to set up a ministerial panel to address various concerns raised by the states on the GST appellate tribunal.